ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

https://theetfbully.com/2011/07/weekly-statsheet-for-the-etfno-load-fund-tracker-updated-through-7142011/

————————————————————

Market Commentary

Friday, July 15, 2011

AGAINST THE WIND

The major market ETFs simply faced too many headwinds and, as a result, the S&P 500 lost 2.1% for the week after two weeks of gains.

No matter where you looked, the news was predominantly negative as Europe’s worsening debt crisis set a sour mood last Monday and Tuesday. On Wednesday, confusion reigned as Fed chief Bernanke, the big flip flopper, left the markets guessing as to future stimulus.

The Disciplined Investor put it best:

After Bernanke’s latest testimony, we may want to consider him the latest King of Spin for this economy. Bernanke has successfully been able to destroy the US Dollar all while keeping a “Strong Dollar Policy”. He has also flip flopped so much on key subjects such as monetary policy that we are not so sure what he has planned next. He has kept Wall Street on their toes that is for sure. Let’s look at his latest testimony to see what we are talking about:

Fed’s Bernanke says given uncertainties about recovery and inflation, Fed remains prepared to adjust stance of policy if appropriate.

then he says… Possibility remains that weakness more persistent than expected, deflation risks may return implying need for more monetary policy support

but then he states…Economy could evolve in a way that would warrant move to less accommodative policy.

So, which is it, accommodative or less accommodative?

Obviously, if the market is confused, it won’t go anywhere, which is exactly what happened on Thursday and Friday. More of a sell off was averted, despite a dismal consumer sentiment report, thanks in part due to Google’s blowout earnings.

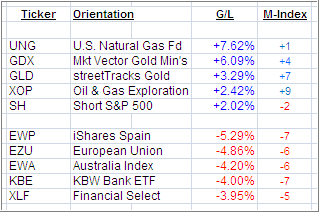

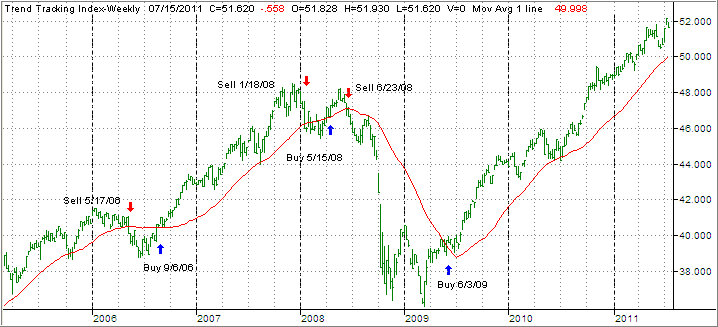

Our Trend Tracking Indexes (TTIs) followed the ups and downs, but a least, for the time being, we got clarification in the international arena, as that index slipped back into bear market territory. Here are the numbers after today’s close:

Domestic TTI: +3.82% (last week +4.54%)

International TTI: -1.28% (last week +1.26%)

While the focus will be on earnings next week, the continued battle about the U.S. debt ceiling will very likely be part of the front page news stories. Throw in some unforeseen events from the European debt circus, and you’ll have a recipe for more uncertainty, which is bound to offer additional support for gold.

Should an agreement be reached in regards to the debt ceiling, look for a relief rally. However, it remains to be seen whether that will simply be a one-day wonder or, if it will morph into more than that. My guess at this time is that any rally will be of limited duration.

Have a great week.

Ulli…

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader Richard:

Q: Ulli: I was fooling around on the Schwab website, and I found an option to “reinvest dividends” (yes/no), on my account holding detail page. They are all marked “no”. I don’t even know if ETF’s pay dividends; I never held one long enough. Anyway is “no” what you want?

A: Richard: Yes, for all of my clients, I have the “no re-investment” of dividends selected. Whenever you re-invest within a taxable account, this tiny amount becomes a new cost basis, which has to be accounted for at year end. That can be an accounting nightmare, even though Schwab provides the cost basis calculations.

My preference is to let the small amounts accumulate and, if market conditions are favorable, invest in a select ETF via a larger amount.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/