- Moving the market

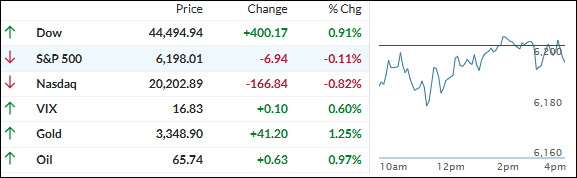

The day started off with the Dow dragging its feet while the S&P 500 and Nasdaq made modest gains.

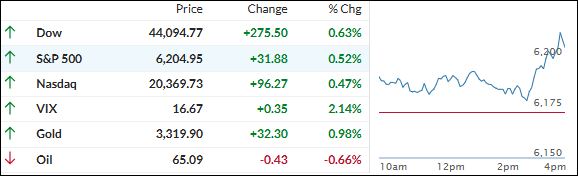

What gave the market a bit of a boost? President Trump announced a finalized trade deal with Vietnam, which helped lift sentiment—at least for a moment.

But then came the ADP private payroll report, and it wasn’t pretty. The private sector lost 33,000 jobs last month—marking the first decline since March 2023. Analysts were expecting a gain of 100,000. Ouch.

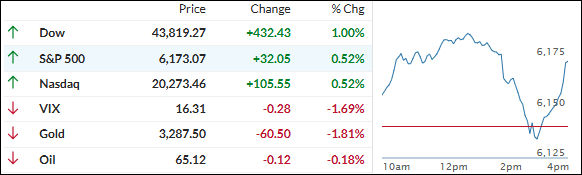

Still, in classic Wall Street fashion, bad news turned into good news. With the Macro Data Surprise Index also taking a dive, traders started betting that the Fed might ease up on interest rates. That sparked a short squeeze, and most major indexes (except the Dow) ended the day in the green, with Small Caps leading the charge.

Traders also kept an eye on Trump’s tax-and-spending bill, which squeaked through the Senate and now heads back to the House. Some GOP holdouts are still making noise, so it’s not a done deal yet.

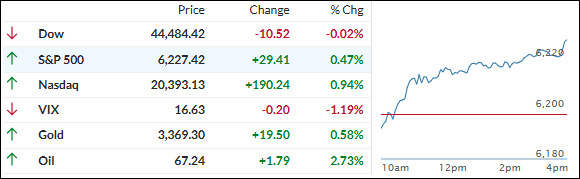

Elsewhere, bond yields dipped early but climbed later in the day. The dollar stayed flat.

Precious metals like gold, silver, platinum, and palladium all rallied, and copper jumped 2.12%. Not to be left out, Bitcoin surged toward its all-time high, fueled by strong ETF inflows and growing bullish sentiment.

And let’s not forget the big picture—global liquidity is still pointing to higher prices ahead.

Read More