- Moving the markets

Yesterday was one of those moments, while watching the futures markets, when I had to laugh out loud. The major indexes were creeping higher when suddenly the bottom dropped out with the Down plunging over 500 points in minutes.

Turns out that Trump’s trade advisor Navarro responded during a Fox News interview regarding the China trade deal: “It’s over. Yes.” The fallout was imminent, and it appears that Navarro got a tap on the shoulder and hastily walked his comments back as “having been taken wildly out of context” pushing the futures back up.

Thanks to ZH, here’s a graphic representation of the events:

And the summary:

Navarro dump – US-China trade deal “is over”

Trump pump – US-China trade deal “fully intact”

Kudlow pump – “absolutely, definitely” no second lock-down due to virus

Fauci slump – “disturbing surge” in infections

Fauci pump – “promising” vaccine is imminent

The regular session had bullish undertones helped by US New Homes Sales, which soared in May, but the manufacturing and service sectors disappointed, as Labor weakness continued.

While the broad market continues to linger, the main story is all about the tech sector with Apple and Netflix scoring to new highs, as the Nasdaq notched a new intra-day record.

Despite the re-opening efforts with business trying to play catchup, Covid-19 is still on everyone’s mind, as MarketWatch reports:

Dr. Anthony Fauci, the nation’s top infectious disease expert, warned on Tuesday that the “next couple of weeks are going to be critical” in terms of the addressing a “disturbing surge” in COVID-19 cases across the United States, while also vowing to ramp up, not slow down, testing for the virus, in testimony before Congress on the federal response to the pandemic.

Again, broad markets lagged, which also explains why our Domestic TTI has not crossed back above its long-term trend line into bullish territory but lingers slightly below it.

This indicates that we continue to be stuck in the neutral zone, meaning we’re holding on to our positions until more evidence of either bullishness or bearishness emerges, which will then signal our next cause of action: Buy more or Sell all.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

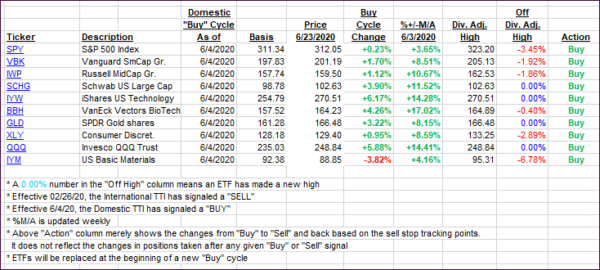

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this new domestic “Buy” cycle, which was effective 6/4/2020, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs improved but not enough for the Domestic TTI to crawl back above its trend line. This could be an ominous sign, since it means that the current rally is narrow and focused only on a few stocks in the tech sector.

This is how we closed 06/23/2020:

Domestic TTI: -1.22% below its M/A (prior close -1.33%)—Buy signal effective 06/04/2020

International TTI: -2.13% below its M/A (prior close -3.10%)—Sell signal effective 02/26/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli