- Moving the markets

An early choppy ride turned out better than expected, as the bullish theme increased momentum and pushed the major indexes to a green close, with especially the Nasdaq showing a solid gain and scoring a new all-time high.

The Dow added a more modest +0.59% but was able to recapture its 26k milestone marker.

The advance was a mixed bag, however, with relentless optimism over a quick recovery for the economy colliding with an increase of Covid-19 infections in about half of the states and in many other parts of the world. This may turn into an ongoing tug-of-war, but at least for today, dreams of a fast recovery prevailed.

As we know, the actual referee deciding this revival will be the Fed and its supporting policies which, however, are limited in scope as financial author Charles Hugh Smith pointed out:

1. It can’t reverse the unprecedented wealth inequality its policies have pushed to the point of social disintegration and breakdown.

2. It can’t make people take on the risks and heartaches of starting new businesses.

3. It can’t force employers to hire more employees.

4. It can’t make unprofitable businesses profitable.

5. It can’t force people to buy assets at prices that no longer make financial sense.

6. It can’t make insolvent businesses and local governments solvent.

7. It can’t force people who now realize their priority is to save money to spend their cash, even if the Fed forces negative interest rates.

8. It can’t lower the unaffordable cost structure of the entire economy.

9. It can’t de-link all the financial dependencies in the financial system that make it so vulnerable to the first domino falling.

10. It can’t stop people from selling their assets.

After the opening last Friday, we saw a different type of decoupling, as ZH points to in this chart from Bloomberg in that Gold and stocks seem to have gone separate ways.

We’ll have to wait and see if this is just an outlier or a realization that reckless money printing will assist the precious metal, the price of which is now within striking distance of taking out Mays’ multiyear highs.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

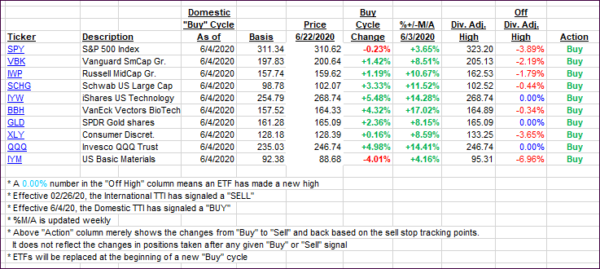

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this new domestic “Buy” cycle, which was effective 6/4/2020, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs changed only by a fraction with the Domestic one stubbornly being stuck slightly below its trend line.

This is how we closed 06/22/2020:

Domestic TTI: -1.33% below its M/A (prior close -0.03%)—Buy signal effective 06/04/2020

International TTI: -3.10% below its M/A (prior close -2.89%)—Sell signal effective 02/26/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli