- Moving the markets

Attempting to cross psychologically important key levels to the upside was the name of the game today with the Dow trying to conquer the 25,000 obstacle, while the S&P 500’s goal was trouncing the 3,000 number.

Both succeeded intraday, but a late sell-off pulled the indexes back below, as reports surfaced that the US was considering transaction controls and asset freezes on Chinese officials and firms.

The early support of this massive rebound came from the usual suspects, namely fresh coronavirus vaccine news and simply optimism for the reopening of the economy, although not much attention was given to the fact that a yet unknown number of businesses have reached the point of no return.

If you are in awe of the March low rebound of the markets, author Charles Hugh Smith shared these succinct thoughts on that topic:

As you’ve probably heard by now, sales don’t matter, profits don’t matter, costs don’t matter, and indeed, nothing matters but the Fed has our back so buy stocks, never mind the valuations. In other words, the U.S. stock market has reached the spiritual level where the corporeal tangible world no longer matters: in a word, Nirvana, or Heaven if you prefer.

If we set aside the satire and the absurd justifications of the financial punditry ( “we see a V-shaped recovery of profits in 2023, or was it in 2032? Never mind, doesn’t matter…”), we discern a reality that should worry us: America’s economy and financial system cannot allow the stock market to decline because any sustained drop will pop the debt-bubble and bring the entire rickety, rotten, corrupt structure down.

The never-ending supply of liquidity, Fed bailouts and outright purchase of bonds will keep interest rates low and the bullish theme alive. All of which is being assisted by the ongoing short squeeze, as Bloomberg shows in this chart. The loser of the day was the US dollar, which saw its biggest daily drop in 2 months.

Our Domestic Trend Tracking Index (TTI) is getting close to signaling a new “Buy,” but I already have started easing into those sector funds that run on their own cycles.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

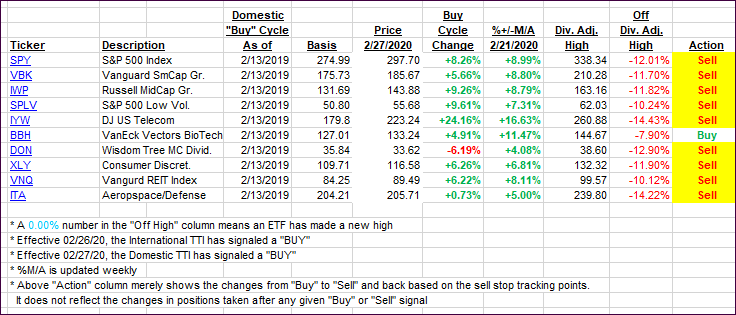

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this past domestic “Buy” cycle, which ended on 2/27/2020, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

Contact Ulli