ETF Tracker StatSheet

You can view the latest version here.

UP FOR THE DAY—DOWN FOR THE WEEK

- Moving the markets

Despite a late-day pump to wipe out some of this week’s losses, the major indexes managed a green close for the session but ended down for the week, with the S&P 500 surrendering a modest -1.3%.

Yes, bad economic news turned out to be good news for the markets. Even crashing Consumer Sentiment (the most terrible ever) and home buying conditions being he worst in 37 years, along with crumbling Durable Goods orders, could not stem the bullish theme and prevent a green close.

As I have noted ad nauseum, equity markets are in no way connected to economic realities, and today was no exception. The fact that global economic data also collapsed by the most on record this week, was of no concern to anyone. Even Monday’s oil debacle now only seems like a distant spot in the rear-view mirror.

However, gold rallied this week, and we added to our existing holdings in anticipation of continued reckless money creation by the Fed, with the eventual destruction of the dollar and a jump in inflation being a logical consequence—over time.

Next week will be a big one with an upcoming Fed meeting, a look at post-shutdown economic growth numbers, and earnings from over 20% of the S&P 500 companies. And, traders will be observing the progress, or lack thereof, of the reopening of some states and the resulting pick up in business activity.

It promises to be another week of unknowns, but the Fed most certainly will attempt to calm the markets and instill some confidence.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

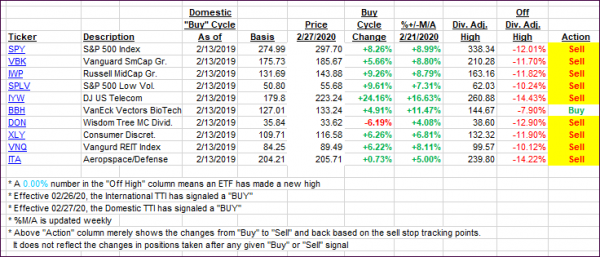

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this past domestic “Buy” cycle, which ended on 2/27/2020, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

In my advisor practice, we may or may not be invested in some of the 10 ETFs listed above.

3. Trend Tracking Indexes (TTIs)

Our TTIs improved slightly, as a last hour ramp pushed the major indexes to a green close.

This is how we closed 04/24/2020:

Domestic TTI: -13.08% below its M/A (prior close -14.65%)—Sell signal effective 02/27/2020

International TTI: -14.46% below its M/A (prior close -15.04%)—Sell signal effective 02/26/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli