ETF Tracker StatSheet

You can view the latest version here.

MARKETS IGNORE MOUNTAINS OF BAD NEWS

- Moving the markets

The creation of rumors is one of the oldest tricks in the financial playbook to send markets in a desired direction.

Such was the case last night in the futures markets, when original reports that the Gilead Company’s trial of Remdisivir in Covid-19 patients was pointing to rapid recoveries in fever and respiratory symptoms. That sent the markets soaring and then correcting on overhyped news that the trial has not even yet concluded.

However, the positive theme remained through this morning’s opening with the major indexes closing solidly in the green more so over the potential of the U.S. reopening “soon.” The White House announced the first guidelines, and it will now be up to the states to determine, if, when and to which degree the recommendations will be applied.

What that means is that today’s rally was again fueled by nothing more than hope and optimism, while totally disregarding economic realities, which I presented all week, such as the latest data showing that the U.S. Leading Economic Indicators crashed by the most in 60 years.

All this is market hype is based on the idea that we’d be quickly returning to normal, once the shut-down is lifted, and the erroneous theory that assumes that we can “turn the key and the economy will restart,” as fund manager/economist Peter Schiff commented.

Peter had a few other spot-on remarks, which represents the cruel reality:

Just because Donald Trump snaps his fingers and says, “Go!” doesn’t mean that the crisis ends. The damage done to the economy is deep. In fact, the economy was already suffering from multiple wounds long before COVID-19 reared its ugly head.

There is no doubt that this downturn will be historic in depth. But the nature of the event behind it is the core hurdle to an economic restart: A health crisis that has killed more than 28,000 people in the country, according to a Reuters tally, and has left fear and confusion in its wake. Behavioral economists note that even much smaller shocks to how people perceive the world can cause lasting effects in how they behave.

It assumes everything was “normal” to begin with. It wasn’t normal. The economy was a big, fat, ugly debt bubble. Normal was abnormal. The economy was levered up to the hilt. Consumers were driving the economy with borrowed money. Corporations were already carrying record debt-loads. The government was already spending money as if we were in the depts of an economic recession.

Coronavirus popped the bubble. It pulled the last piece out of the Jenga game. It turned a fan on the house of cards. We’re not going back to normal any time soon.

We have a debt bubble. Now, everybody is defaulting on their loans. It doesn’t matter why they’re defaulting. All that matters is that they defaulted. And the cat’s out of the bag now. It’s gone. It’s over. The bubble has popped and now we are dealing with the consequences, not just of the virus, but of the consequences of the bubble.

In fact, we’re dealing with the consequences of the bubble that popped in 2008. We’re dealing with the consequences of the bubble that popped in 2001. Because we never finished dealing with them. Because the Fed kicked the can down the road, and we’ve caught up with that can.

As far as current market levels are concerned, Guggenheim’s Scott Minerd added what I have been saying for quite a while:

“The market at this level based upon where earnings are doesn’t represent any kind of intrinsic value, it is being entirely propped up by liquidity.”

“S&P could be 1,500, 1,600, 1,200.”

Closing out the week, this is what we witnessed:

Crude oil crashed, a record surge in Covid-19 deaths and unemployment, while the markets exploded higher with the S&P 500 adding some 3%, although on severely lagging volume.

While this is current reality, it will not end well. Even on a global basis, earnings expectations are collapsing, while stocks are soaring—but only for this reason.

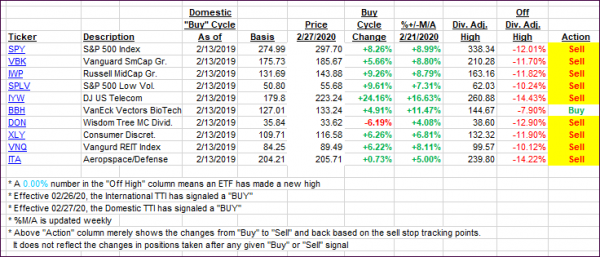

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this past domestic “Buy” cycle, which ended on 2/27/2020, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

In my advisor practice, we may or may not be invested in some of the 10 ETFs listed above.

3. Trend Tracking Indexes (TTIs)

Our TTIs improved as bad news was good news with the major indexes scoring a win this week.

This is how we closed 04/17/2020:

Domestic TTI: -11.98% below its M/A (prior close -15.42%)—Sell signal effective 02/27/2020

International TTI: -13.23% below its M/A (prior close -16.05%)—Sell signal effective 02/26/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli