ETF Tracker StatSheet

You can view the latest version here.

STUCK IN BEAR MARKET TERRITORY

- Moving the markets

Despite a concerted effort to pump the major indexes back up, after sharp declines, the result still produced red closes, but at least some of the losses were reduced. It did not prevent the Dow from having put together its second longest run of Friday losses, namely 7 straight, since the string of 8 Friday losses came to an end in July 2006.

The uncertain environment about the corona virus has been a concern for traders and investors alike, especially when heading in the weekend with long positions. Therefore, Friday’s have become one of the scariest days, because it’s pretty much guaranteed that more bad news can/will affect equities come Monday morning.

Even today’s blockbuster jobs report merely elicited a shoulder shrug, as if to say, “who cares, there are more important concerns.” Nevertheless, 273k jobs were added in February vs. expectations of 175k. In more good news, December’s report was revised upward from 147k to 184k, while the same happened in January: 225k to 273k. These are numbers that under normal conditions would have produced some fireworks in equities—but no such luck today.

This Bloomberg chart summarizes the market action after the Fed’s emergency rate cut showing that equities and bonds/gold went their separate ways. But what about the resurgence of the Fed’s balance sheet, which has been the guiding light for stocks? As this chart points out, despite the Fed’s efforts, it did not work out as planned.

Things are topsy-turvy with the biggest irony being displayed in this chart, which shows that China, the very country in which the coronavirus originated, has had a better stock market performance than the U.S. and Germany. Go figure…

In this debacle, the banks have been hit the hardest, with their Bank Index having come down some 27% from their early January highs. Ouch!

It’s good to be on the sidelines.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can again.

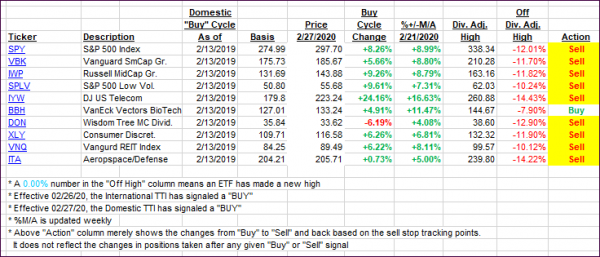

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this past domestic “Buy” cycle, which ended on 2/27/2020, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs headed south again, as the bears ruled the day.

Here’s how we closed 03/06/2020:

Domestic TTI: -6.42% below its M/A (prior close -0.95%)—Sell signal effective 02/27/2020

International TTI: -7.05% below its M/A (prior close -3.20%)—Sell signal effective 02/26/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli