ETF Tracker StatSheet

You can view the latest version here.

ENDING A BRUTAL WEAK WITH A RELIEF RALLY

- Moving the markets

The markets finally managed to keep a rebound rally going after yesterday’s collapse. As I posted, during bear markets, you can witness violent upswings, but they don’t mean the bearish trend is over.

Today, we started in the green, as news from Europe that the German FinMin unleashed their version of a financial bazooka and presented their “whatever it takes moment:”

- SCHOLZ SAYS POSSIBLE GERMANY WILL NEED TO TAKE ON ADDED DEBT;

- GERMANY WILL HAVE NO LIMIT ON CREDIT PROGRAM FOR COMPANIES;

- SCHOLZ SAYS GERMANY WILL SPEND BILLIONS TO CUSHION ECONOMY;

- GERMANY PLANS TO SET UP SAFETY NET FOR VIRUS-HIT COMPANIES;

- ALTMAIER: RESOURCES FOR GERMANY’S STATE BANK TO RISE TO 500BN

That set the bullish tone for the day, and up we went. Adding hope for a quick response domestically were reports that House Speaker Pelosi and the Trump Administration were nearing an agreement on an aid package, to include sick pay free virus testing and other resources.

Then it was the Fed’s turn to announce their “whatever it takes moment,” by attempting to restore some liquidity in the broken overnight lending market by concluding three of six emergency POMOs (Permanent Open Market Operations) and soaking up billions of Treasuries of varying maturities.

Towards session end, it was Trump’s stimulus/testing plan that spiked equities to their biggest gain since October 2008, thereby somewhat offsetting the market’s worst week since 2008, during which the S&P 500 dropped -8.8%.

Even diversification did not help, as this week was the worst weekly loss for a diversified portfolio of stocks and bonds since 2008 with -14.69%, as Bloomberg points out in this chart.

Next week, the Fed will meet, and the markets are “demanding” a full 1% interest rate cut with Bloomberg providing the graphic representation. You can be pretty much assured that the Fed will cave and comply, otherwise the current debacle will continue in an accelerated fashion.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

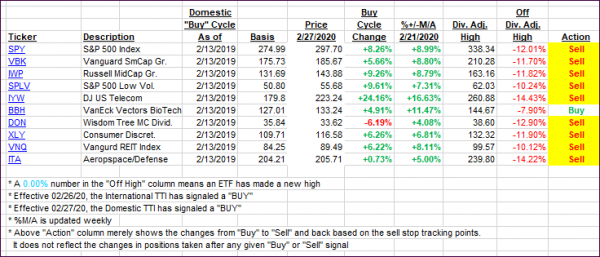

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this past domestic “Buy” cycle, which ended on 2/27/2020, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs reversed, as the markets finally managed to put a rebound together, but we still remain solidly on the bearish side of our respective trend lines.

Here’s how we closed 03/13/2020:

Domestic TTI: -17.34% below its M/A (prior close -23.80%)—Sell signal effective 02/27/2020

International TTI: -20.01% below its M/A (prior close -23.62%)—Sell signal effective 02/26/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli