ETF Tracker StatSheet

You can view the latest version here.

STUMBLING INTO THE WEEKEND

- Moving the markets

Despite predominantly trading sideways over the past 2 days, the major indexes managed to eke out a gain for the week with the S&P 500 adding +1.6%.

Uncertainty about the coronavirus, especially the reporting accuracy, left many wondering what the true status might be, after China changed the government’s counting method.

Rabobank summed it up like this:

Not so pleasing is that there is genuine confusion on how many people are being tested; how they are being tested; how they are being classified; and how many people are actually dead. This kind of confusion is something markets have learned to live with over a little matter like Chinese GDP; it’s not so easy when it comes to something you live or die with, like a virus.

Surprisingly, so far, the markets have taken this uncertainty with a grain of salt without a substantial pullback, while the three benchmarks touched all-time highs earlier in the week.

From the economic calendar, we learned that retail sales rose 0.3% last month, import prices climbed 0.2% and industrial production headed south again by declining the fourth time in five months. Neither of these numbers had any measurable market effect.

In the end, the indexes closed the week with a last hour pump assuring a green close for at least the S&P 500 and the Nasdaq, both of which closed at all-time new highs. Of course, we have learned not to look at underlying fundamentals, such as this chart by Bloomberg shows, which paints a different picture in terms of what market direction should be.

We continue to follow the major trends which, despite the ever-present coronavirus scare, continue to plow deeper into bullish territory.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can again.

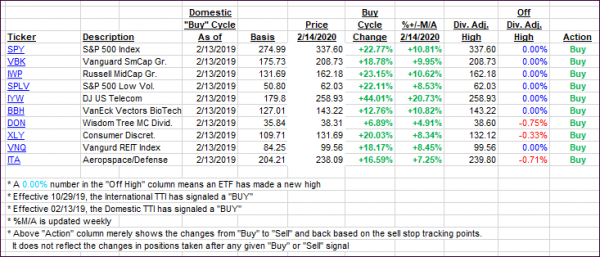

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they

have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) came off their highs but remain solidly on the bullish side of their respective trend lines.

Here’s how we closed 02/14/2020:

Domestic TTI: +8.42% above its M/A (prior close +8.90%)—Buy signal effective 02/13/2019

International TTI: +5.80% above its M/A (prior close +6.59%)—Buy signal effective 10/29/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli