- Moving the markets

While yesterday’s initial market reaction to the signing of the Phase-1 US-China trade deal was merely a yawn followed by a modest sell-off, today things looked different.

Optimism was soaring with the major indexes scoring new record highs, as traders had a chance to digest the trade truce. The 96-page agreement lays out that China is supposed to purchase $95 billion more in US commodities than in 2017, and roughly more than $100 billion in manufactured goods and services, according to MarketWatch.

However, as always, doubt exists whether this agreement can lead to a lasting accord, as the Phase-2 negotiations are being prepared. But, for right now, the markets are pleased that expectations have been met. Also throwing an assist was the Senate approval of a new trade deal between the U.S., Mexico and Canada, along with a huge short squeeze.

On the economic front, things took a turn for the better with the Philly Fed Business Outlook spiking from a revised 2.4 to 17, which was far above expectations of 3.8. Then December Retail Sales surprised to the upside, despite an Online Sales slowdown, according to ZH. Ex-autos, the index surged 0.7% vs. and expected 0.5% rise.

Of course, all of this pales compared to the real reason for the ongoing market levitations, namely the growth of the Fed’s balance sheet, as this chart shows. To be clear, it’s not just the Fed, but all Central Bank policies in unison, that seem to push equity prices to ever higher levels.

Right now, we are enjoying the ride.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can again.

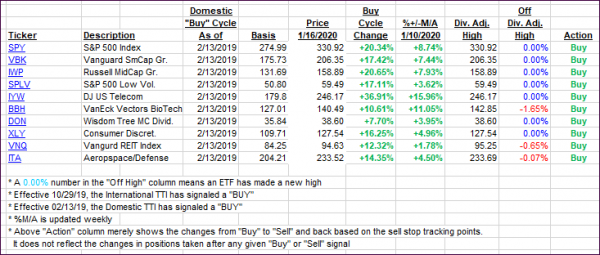

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) jumped with the domestic one showing more firepower that its international cousin.

Here’s how we closed 01/16/2020:

Domestic TTI: +9.49% above its M/A (prior close +8.48%)—Buy signal effective 02/13/2019

International TTI: +6.93% above its M/A (prior close +6.58%)—Buy signal effective 10/29/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli