ETF Tracker StatSheet

You can view the latest version here.

Markets Suffer From An Infection

- Moving the markets

An early bounce turned out to be short-lived, as ongoing issues with the coronavirus infected the markets, with equities registering their first losing week for this year. Despite the pullback, the S&P 500 remains still up by almost 2% for 2020.

A last hour rebound reduced losses, which were less than 1% for the major indexes. Again, the fear is that China’s coronavirus may disrupt travel and slow down global growth.

Even good quarterly earnings reports by Intel and American Express were not enough to establish confidence and motivate dip buyers to step in.

ZH summed up the market effects like this:

- Shanghai Comp’s worst week in 8 months

- S&P 500’s worst week in 5 months

- “Most Shorted” stocks had their biggest weekly drop in 4 months

- France’s CAC 40 worst week in almost 4 months

- VIX’s biggest weekly spike in almost 6 months

- HY Bond Prices worst week in almost 5 months

- Treasury yields biggest weekly drop in 4 months

- Yield curve’s biggest weekly flattening in 2 months

- USD’s best week in 2 months

- Yuan’s worst week in 4 months

- Copper’s worst week in over 5 years

- Oil’s biggest weekly drop in 8 months

- Gold’s 6th weekly rise in last 7 weeks

Despite various squeeze attempts, when looking at the entire week, the most shorted stocks won the squeeze fest for a change by doing what they do best, go lower.

With weakness in the markets being prevalent, you would have thought that the divergence between stocks and bonds would finally narrow, but it didn’t, as this chart from Bloomberg shows. Sure, stocks dropped but so did bond yields, thereby keeping the spread as wide as ever.

The propagation of the virus, or hopefully its containment, will be closely watched over the weekend, but it will likely have further effects on market direction.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can again.

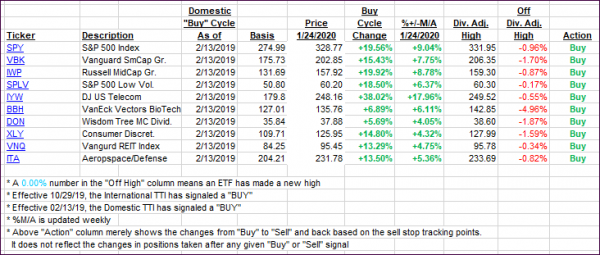

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) headed south as worries about the coronavirus took any starch out of upward momentum.

Here’s how we closed 01/23/2020:

Domestic TTI: +7.63% above its M/A (prior close +9.02%)—Buy signal effective 02/13/2019

International TTI: +5.62% above its M/A (prior close +6.07%)—Buy signal effective 10/29/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli