- Moving the markets

As I pondered yesterday, the While House indeed fired the next salvo about the trade talks, but it was not what the markets expected. Stocks got hit hard when Trump announced that the idea of holding off on a US-China trade deal until after the 2020 election was appealing.

This undermined confidence and hope, by traders and computer algos alike, that a deal may be completed before new import tariffs are scheduled to be imposed by December 15.

At the same time, the US threatened 100% tariffs on some $2.4 billion in French goods over their digital tax, which has adversely affected US tech companies. Additionally, potential tariffs on countries like Brazil and Argentina were on the menu as well.

That seemed to conclude or end, at least for the time being, the game of endless headlines spouting the “a trade deal is close” theme designed to pump the markets to ever new highs.

Especially the past two days have seen a sudden and dramatic reversal in sentiment, as a result of less-than-positive trade deal comments. The market implied odds of a trade deal have now plunged.

One of Nomura’s analysts summed it up this way:

“What forced self-reinforcing buying pressure on the way up is about to feed a vicious cycle of selling on the way down.”

That simply means some of the big players are chomping at the bit to short the markets, but only once a certain level has been hit. So, great news, such as the good old standby “a trade deal is close,” are sorely needed, in order to stem current downside momentum.

The 10-year bond yield collapsed 10.6 basis points to end at 1.72%. That’s a huge move, and it finally showed the discrepancy between bond yields and the Dow narrowing dramatically, as ZH pointed out with this chart. The S&P 500 had its worst start to a December since 2008. A tip of the hat goes to Bloomberg for this graph.

While we witnessed a slow crawl back from the day’s lows, it was not nearly enough to get back to even, as the possibility of a postponed trade deal was simply too much of a negative to overcome.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

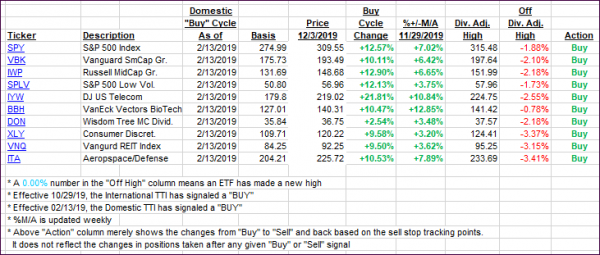

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) took a dive, as negative trade comments supported only the bearish crowd.

Here’s how we closed 12/3/2019:

Domestic TTI: +4.41% above its M/A (prior close +5.26%)—Buy signal effective 02/13/2019

International TTI: +2.32% above its M/A (prior close +3.14%)—Buy signal effective 10/29/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli