ETF Tracker StatSheet

You can view the latest version here.

GLOBAL GROWTH FEARS STOP BULLISH MOMENTUM

- Moving the markets

This is an early and short version of Friday’s commentary, since I will be tied up this afternoon. The markets are still open and will be for another 3.5 hours.

We saw early weakness in part caused by China’s worst GDP growth in 30 years registering 6%. As a result, stocks worldwide pulled back modestly but appear on track to close out the week on the plus side.

Not helping matters was ECB’s Mario Draghi, who will leave office later this month, but couldn’t help himself to issue a warning that he sees “mild signs of over-stretched valuations in markets,” contributing to the early softness in stocks.

Despite relatively upbeat earnings so far, it seems that a fresh stimulus for equities is needed considering slowing Chinese activity and the ever-changing stories about the upcoming Brexit and the US-China trade saga. After all, for the S&P to break through its overhead glass ceiling, I believe it will take more than your hyped news headlines to bring about a push of this bullish trend to new all-time highs.

On a personal note, and the reason for this early release commentary is this. I saw my ophthalmologist a couple of days ago, and he performed an office procedure to fix a partially detached retina. At this time, it appears that it was not successful, and I will have to undergo surgery tonight. The final call will me made this afternoon. I expect to resume posting on Monday again.

Please note that section 2 and 3 below contain yesterday’s data, and I hope to make the update sometime this weekend.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

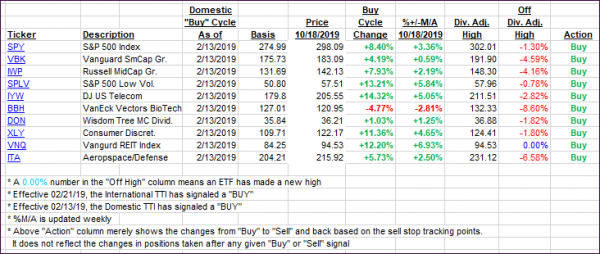

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) slipped as a late session sell-off thwarted any bullish attempts.

Here’s how we closed 10/18/2019:

Domestic TTI: +2.89% above its M/A (prior close +2.78%)—Buy signal effective 02/13/2019

International TTI: +1.15% above its M/A (prior close +1.24%)—Sell signal effective 10/03/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli