- Moving the markets

The market got an unexpected assist, which prevented a continuation of yesterday’s slide; at least for the time being. Retail sales surged in July, but that does not mean all is well, as these surges in the past have been followed by contractions. But for this moment in time, it was a positive with sales gushing +0.7% MoM vs. an expected +0.3%.

Then WalMart delivered better-than-expected second quarter earnings, as well as same store sales growth, while projecting even better numbers in the future. We also learned that US productivity increased 2.3% in the last quarter after a healthy 3.5% gain in the first 3 months.

These numbers put the US-China trade dispute on the back burner, but a spokesman for China’s foreign ministry seemed to throw out this olive branch:

“We hope the U.S. can work in concert with China to implement the two presidents’ consensus that was reached in Osaka, and to work out a mutually acceptable solution through equal-footed dialogue and consultation with mutual respect.”

This was counter to an earlier comment that threatened unspecified retaliation against Trump’s threat to impose more tariffs in September. And so, the jawboning goes on…

The WSJ reported that the European Central Bank (ECB) is in the process of revealing a stimulus package at its next meeting in September that should exceed investors’ expectations. In other words, things are so bad, economically speaking, that only a shock-and-awe effect will revive Europe’s sagging economies.

As a result, the 10-year US bond yield took a dive below the 1.5% level to touch 1.48% before rebounding. That was the lowest price in three years and confirms that the race to the bottom will accelerate. If you think, zero percent interest rates are simply insane, you are correct.

Look across the Atlantic towards Denmark, where this idiocy has now morphed into negative mortgage rates. Denmark’s 3rd largest bank is now paying people to take out a mortgage.

In the end, the markets meandered aimlessly with the absence of bulls and bears marking a day that was clouded by confusion and uncertainty. However, it was a good environment for those of us holding the low volatility ETF SPLV, which advanced +1.11% vs. the SPY’s more meager +0.26%.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

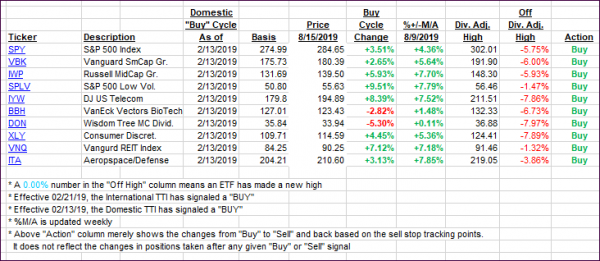

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) offered a mixed view of the markets. The Domestic one stayed put, while the International dove deeper into bearish territory and consequently confirming yesterday’s ‘Sell’ signal.

Here’s how we closed 08/15/2019:

Domestic TTI: +0.08% above its M/A (prior close +0.05%)—Buy signal effective 02/13/2019

International TTI: -2.79% below its M/A (prior close -2.39%)—Sell signal effective 08/15/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli