ETF Tracker StatSheet

You can view the latest version here.

BAD NEWS IS GOOD NEWS—AGAIN

- Moving the markets

Never mind poor economic news such as a huge payroll miss, as only 75k new jobs were created during the month of May. That was against a consensus of 175k, so you would be thinking clearly had you expected a subsequent sell-off in the equity markets.

Well, that is not how it works these days. The worse the economic numbers, the greater the likelyhood that the Fed ‘could’ lower interest rates, which would be a boost for the stock market. Of course, the economy has been showing weakness wherever you look, which has been the justification for bond yields to head as far south as they did.

Unfortunately, those low bond yields are painting a picture of a possible recession, while the S&P 500 paints a picture of economic growth, which has created this conundrum with one analyst correctly observing that Bonds are from Venus and Stocks are from Mars.

Eventually a re-syncing will have to occur, and my guess is that the ‘smart money’ (bonds) will win this battle ultimately. This simply means that stocks will have to catch down to the reality of low bond yields—eventually.

In the end, it was the Fed’s jawboning about possible lower rates that sparked the best week for equities in some 6 months, which in the past did not end well, as that chart shows.

And for some Friday humor, ZH quipped:

“Markets jump on optimism U.S. economy sliding into recession.”

“The Fed won’t cut rates until stocks plunge, which won’t happen because the Fed is expected to cut if stocks plunge…”

And then posing this question tongue-in-cheek:

So, Finally, what drove this week’s almost unprecedented surge in stocks?

Answer:

Simple – Trump launching Mexican, Indian trade war; US labor market cracking; US GDP slowing; German manufacturing collapsing; S. Korean export drop needs a bigger chart; Global PMIs plunging; bond yields crashing…

Other than that, everything is fine, but I’m left pondering “how much upside is really left?”

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

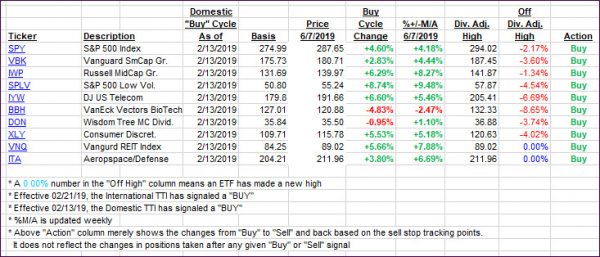

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) jumped with the International one now being on the positive side of its trend line for the second day. I’d like to see a little more upside confirmation next week before declaring this ‘Sell’ signal to be over.

Here’s how we closed 06/07/2019:

Domestic TTI: +4.14% above its M/A (last close +3.49%)—Buy signal effective 02/13/2019

International TTI: +1.11% above its M/A (last close +0.05%)—Sell signal effective 05/30/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli

Comments 2

Hey, Uli

Another week; another series of your posts assuring us that the market is poised for an inevitable crash. I mean, all the indicators point to that, right? But never mind the signals, the “algos,” et. al., are working insidiously behind the scenes to keep the market propped up. And all the investors who are driving the market are naifs, living in Ground Hog Day.

So I conclude critical thinking is a waste of time. Buy the S&P 500, engage autopilot, eat, drink, and be merry, huh?

Smokey

6/7/19

Author

Smokey,

You never know. When markets are driven only by hype and hope, I prefer to remain critical.

Ulli…