ETF Tracker StatSheet

You can view the latest version here.

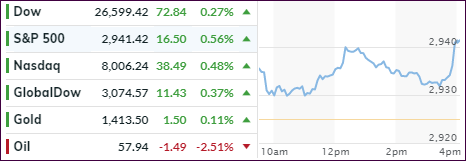

EDGING HIGHER ON HOPE FOR U.S.-CHINA TRADE PROGRESS

- Moving the markets

While the major indexes traded above their respective unchanged lines throughout the session, a late push higher appeared to put an exclamation mark at the end of the day, as if to imply that the U.S.-China talks better result in a positive outcome.

Still, the gains were modest, as traders are anxiously awaiting tomorrow’s meeting between Trump and Xi in Japan as part of the G-20 powwow. With threats and conditions having been thrown back and forth, I don’t see much headway being made. After all, for Trump to declare that he made the best trade deal ever, the Chinese would have to admit defeat, and that is not going to happen.

In the end, the month of June proved to be the “comeback” month of the year with the S&P 500 gaining some +6.87%, its best performance since 1955. While that sounds great on the surface, let’s not forget that the index lost -6.59% in May. In other words, we’re about back to where we were on April 30th, namely 2,946 vs. today’s close of 2,941.

Looking at a bigger time frame, like the past 17 months, we see in the following chart that the S&P 500 peaked at 2,873 in February 2018 and closed today at 2,941. That is a jaw dropping return of +2.37%:

Not exactly awe inspiring, but caused by Fed policy blunders, like hiking rates, pushing equities down, then reversing policy and shoving them higher.

This is also typical of markets that are driven by headline reading computer algos without regard to underlying fundamentals. Had those been paid attention to, we’d be at much lower levels than we are now.

Be that as it may, should the trade deal die on the vine, markets will correct, but could very well be rescued by the Fed, should they implement that much demanded 50 bps reduction in interest rates. In the meantime, the decoupling between stocks and bonds continues at an unprecedented rate.

It promises to be a month of July that could be full of surprises.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

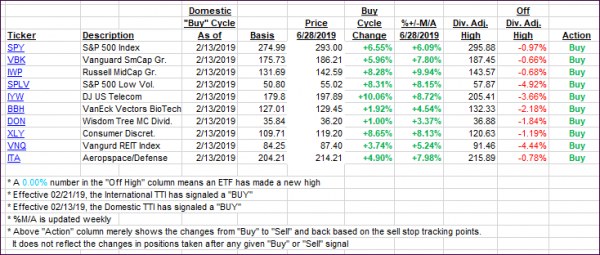

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) jumped as bullish momentum prevailed.

Here’s how we closed 06/28/2019:

Domestic TTI: +6.74% above its M/A (last close +5.37%)—Buy signal effective 02/13/2019

International TTI: +4.12% above its M/A (last close +3.69%)—Buy signal effective 06/19/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli