ETF Tracker StatSheet

You can view the latest version here.

TRADE WAR #2 CAUSES A SEA OF RED

- Moving the markets

The markets got ambushed last night after Trump’s announcement that tariffs on Mexico will be imposed as of June 10th in order to force the country to stem the tide of the ever increasing number of immigrants crossing the border into the U.S.

The tariff penalty was dramatic in magnitude starting at 5% in June and increasing monthly by that same amount until a level of 25% is reached, or until illegal immigration across the southern border is stopped substantially.

This event was black-swan like in that nobody saw it coming. Wordwide, markets reacted accordingly and sold off with major indexes surrendering over 1.25% on the last day of an already miserable month. The S&P 500 not only broke and closed below its 200-day M/A but also had its biggest weekly drop since December, while Europe scored its worst month since early 2016.

The risk has now increased that the bears may have gained the upper hand, as bullish bumps have made room for bearish selloffs, which means that a world-wide recession could very well be on the horzion. Our International TTI has led the way so far and has crossed into bear market territory with that ‘Sell’ signal being effective as of 5/30/19.

The bond market continued its freefall with the yield on the 10-year plunging to 2.13%, a level last seen in September 2017. Worldwide, the divergence between yields and equities continues, as this chart shows. A synching up will occur at some point. However, if equities end up “syncing down” to yields, that would mean a correction of some 29%. Ouch.

In the meantime, our Domestic TTI has also crossed its trend line to the downside and into bear market territory alerting us to a potential ‘Sell’ signal. See section 3 for details.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

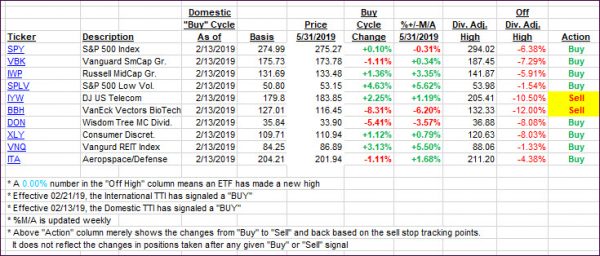

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) headed south with the International one sanctioning yesterday’s ‘Sell’ signal. It’s Domestic cousin also crossed below its respective trend line, but I will for further downside confirmation before pulling the trigger.

Here’s how we closed 05/31/2019:

Domestic TTI: -0.64% Below its M/A (last close +0.37%)—Buy signal effective 02/13/2019

International TTI: -2.40% below its M/A (last close -1.68%)—Sell signal effective 05/30/2019

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details here.

———————————————————

Back issues of the ETF Tracker are available on the web.

Contact Ulli