ETF Tracker StatSheet

Battling Back And Finishing Mixed

[Chart courtesy of MarketWatch.com]- Moving the markets

For the second day in a row, the markets opened in red with the Dow down over 200 points, as yesterday’s issues (sluggish global growth and U.S.-China trade tensions) weighed heavy on sentiment.

Especially the trade war was on traders’ minds, when Trump confirmed that he had no plans to meet with Chinese President Xi before a March 1 deadline. However, rumors have it that the tariff increase was reduce to “only” 10% rather than the scheduled 25%.

That helped the markets to crawl back and trim the early losses with the S&P 500 and Nasdaq conquering the unchanged line thanks to a last 30 minute “shove” into the green. For the week, the S&P ended just about unchanged. That’s amazing when you consider that forward earnings expectations are continuing to plunge yet equities manage to hold on.

Technically speaking, the S&P 500 needs to conquer its 200-day M/A in order to provide some impetus for the bulls to keep pushing to higher levels. Without it, we may be stuck in a trading range for a while until a break, either up or down, occurs that will determine future market direction.

With the Fed now being on the side of Wall Street, after having brushed anticipated rate hikes aside, my current guess is that we are heading higher; it’s just a matter of ‘when.’

Such a move will very likely get us back in the market again, since our Domestic TT is already tightly hovering around its trend line, which is the divider between bullish and bearish territory. Stay tuned…

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

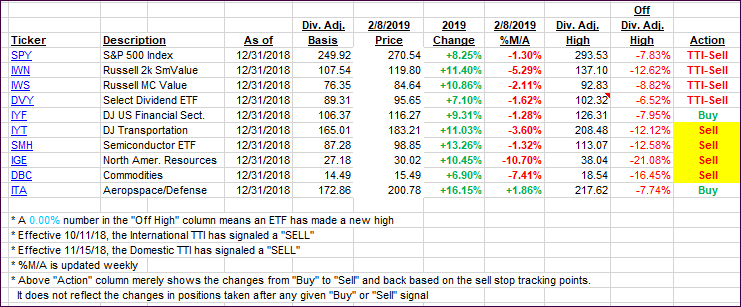

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our original candidates from the last cycle have fared:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) closed mixed, but thanks to a market reversal, the Domestic one conquered its trend line again but only by a tiny margin. We will again show patience and wait for some staying power above the line before easing back into the market.

Here’s how we closed 02/08/2019:

Domestic TTI: +0.11% below its M/A (last close -0.06%)—Sell signal effective 11/15/2018

International TTI: -1.73% below its M/A (last close -1.47%)—Sell signal effective 10/11/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling.

————————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli