ETF Tracker StatSheet

SNAPPING THE WIN STREAK BUT GAINING FOR THE WEEK

[Chart courtesy of MarketWatch.com]- Moving the markets

Today was almost a repeat from yesterday’s session in that we started sharply to the downside, but bullish momentum appeared and pulled the major indexes up, but they fell a tad short of crossing above the unchanged line.

For the week, the Dow gained 2.4%, the S&P 500 ended up 2.5% while the Nasdaq took top billing with +3.5%. While these were nice advances, remember that they are not actual gains but merely represent a making up of some of the losses sustained by the Buy-and-Hold crowd, since our last Sell signal became effective on 11/15/18.

Since that date, the S&P 500 (SPY), for example, is still down -5.14%, which means that this exact percentage gain is required for those who stayed invested to get back to “even” when compared to the Trend Tracking strategy. So, the headlines that “the stock market just got off to its best start in 13 years” conveniently forgets that Q4 2018 was on the of the worst ever with the S&P 500 surrendering -14% thereby neutralizing the effect of this “best start.”

Potential bull markets start in bear market territory and vice versa meaning that the rebound of the last few weeks should come as no surprise. Slumping macro data, tumbling earnings expectations and the Fed’s balance sheet reductions, however, are headwinds that computer algos, who control most of the trading, simply ignored but which still need to be dealt with.

However, it’s questionable at this moment in time whether there are enough catalysts available to keep upward momentum going to a point, where a new bull market starts and our Trend Tracking Indexes (TTIs) give the go ahead. Right now, it would take another +5% advance of our Domestic TTI to cross above its long-term trend line.

With the markets see-sawing and moving violently daily, any outcome is possible, no matter how unlikely or improbable. The current positive market theme could continue or end with a sudden bang. No one has the answer, despite many MSM headlines proclaiming that they do. It’s best not to get suckered into making emotional decisions, which for me means tracking our TTIs and waiting patiently for a new “Buy” signal to develop.

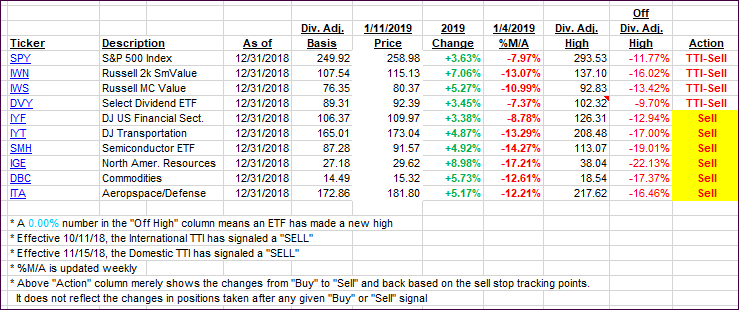

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our original candidates from the last cycle have fared:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) again moved a tad closer towards a potential upside break of their trend lines.

Here’s how we closed 01/11/2019:

Domestic TTI: -4.46% below its M/A (last close -4.89%)—Sell signal effective 11/15/2018

International TTI: -4.69% below its M/A (last close -4.90%)—Sell signal effective 10/11/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling.

————————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli