- Moving the markets

Equities finally managed to stage a long-overdue rebound from extremely oversold conditions but still leaving the major indexes far short of returning to bullish territory.

Getting things started were comments by President Trump yesterday attempting to calm the investing crowd after the pre-Christmas disaster. Words like “buy the dip,” “I have great confidence in our companies, they’re the greatest in the world and are doing well,” got an early rebound going, but that was not the main driver behind today’s surge.

The real firepower came from the U.S. Defined Benefit Pensions fund that needed to implement a “giant rebalancing out of bonds into stocks,” assumed to be the largest in history. Wells Fargo estimated about $64 billion in equity purchases were necessary during the last trading days of the quarter and year to accomplish that mission.

Here are some details:

For those who missed our Friday post on the topic, Wells explained where this massive rebalancing comes from: the huge, end-of-quarter buy order was precipitated by the jarring divergence between equity and bond performances both in Q4 and the month of December. The stocks in the bank’s pro forma pension asset blend had suffered a 14% loss this quarter, including about an 8.5% drop in December. Contrast this with a roughly +1.6% quarterly total return for the domestic aggregate bond index.

As a result of this need for massive quarter-end rebalancing, corporate pensions would need to boost their equity portfolios by as much as $64 billion into year-end.

With a lot of CTAs (Commodity Trading Advisors) and hedge funds having turned short, this was not a good day for them, as the short squeeze turned out to be the biggest since the Brexit. Ouch!

My view has always been that a bear market will allow for short positions, but only once it has been established. Right now, we are in the beginning stages, where increased volatility in both directions can wreak havoc with even the most thought out plans.

That’s why portfolio safety is rule number one. Being out of equities and in money market is the safest and most sensible place to be at this time.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

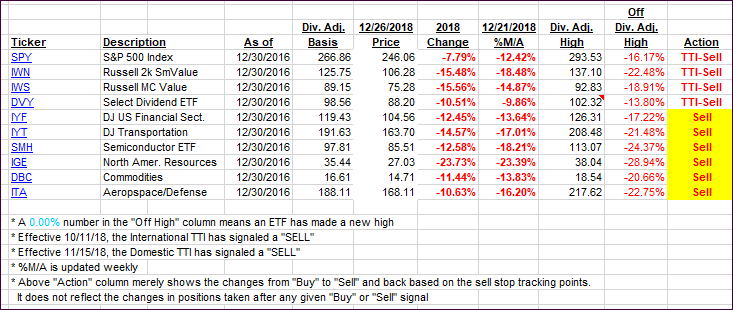

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our original candidates have fared:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) recovered strongly as today’s massive rebound gave the bulls some hope. The question is “how long will it last?”

Here’s how we closed 12/26/2018:

Domestic TTI: -11.43% below its M/A (last close -15.27%)—Sell signal effective 11/15/2018

International TTI: -10.77% below its M/A (last close -12.03%)—Sell signal effective 10/11/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling.

Contact Ulli