- Moving the markets

An early ramp ran into resistance around mid-day when sentiment turned bearish, and sellers pulled the major indexes not just off their high points but also to a close at the lows of the day. Good thing the clock ran out, or we might have seen another reversal with nothing to show for.

As it turned out, the major indexes managed to score some modest gains with early support coming from the main recent driver of market direction, namely boosted expectations that a US/China trade deal might materialize in the coming months. Translated, that means to me that we’ll be riding this roller-coaster a while longer until something definite and verifiable can be reached between the jawboning parties.

Other positives out of China were news that they might allow foreign corporations greater access to their markets, and that they will lower tariffs on US autos and increase soybean purchases. While these are steps in the right direction, they were simply not enough to keep early upward market momentum going, as headlines about Cohen and National Enquirer disclosure offset the exuberant mood.

In the end, the modest gains certainly were not enough to conquer any bearish tendencies, as our Trend Tracking Indexes (TTIs) improved slightly but remain firmly entrenched below their respective long-term trend lines.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

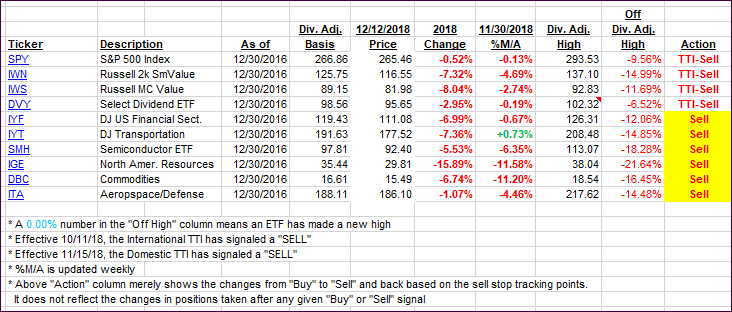

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our original candidates have fared:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) improved with especially the International jumping from yesterday’s close.

Here’s how we closed 12/12/2018:

Domestic TTI: -4.39% below its M/A (last close -4.87%)—Sell signal effective 11/15/2018

International TTI: -5.99% below its M/A (last close -7.08%)—Sell signal effective 10/11/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling.

Contact Ulli