- Moving the markets

Global markets in general collapsed early on with the Dow at one point being down over 700 points, and that only after only 1.5 hours’ worth of trading. Contributing to the sour mood were news of the arrest of the chief financial officer of Chinese Telecom equipment maker Huawei.

Canadian officials arrested the CFO for potential extradition to the US for allegedly violating sanctions against Iran. While Meng Wanzhou was detained in Vancouver on Saturday, the news was only recently released, meaning that Trump and Xi had dinner at the G-20 meeting without this incident being made public, which sort of may have put another nail in the trade coffin.

European stocks joined that party and had their worst session in over 2 years with slumping oil prices adding to the declines. In the US, negative economic news, such as US factory orders tumbling the most in 15 months and initial jobless claims hovering at 6-month highs, were simply ignored in spite of softening indicators everywhere.

In the end, only the US markets managed a magical comeback (thanks to the Plunge Protection Team?) with the major indexes climbing steadily from mid-day on. While the Nasdaq managed to close in the green, the Dow and S&P 500 cut their sharp early losses as well and ended in the red by an insignificant margin. Helping the rebound was a well-timed article by the WSJ indicating that the Fed might not hike in December.

Our Trend Tracking Indexes (TTIs) remain in bear market territory, and we’re out of the market for the time being (since 11/15/18).

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

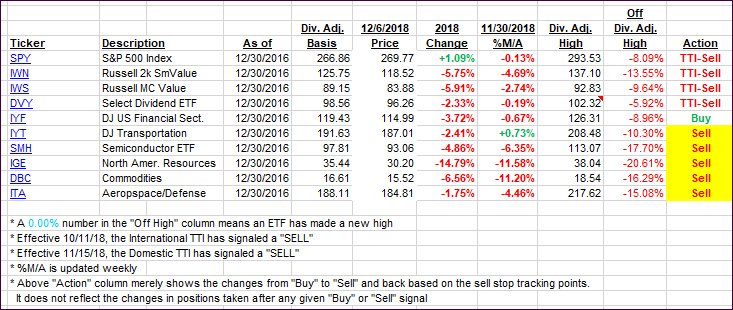

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our original candidates have fared:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) slipped with the International one taking a steep dive.

Here’s how we closed 12/6/2018:

Domestic TTI: -2.63% below its M/A (last close -2.34%)—Sell signal effective 11/15/2018

International TTI: -5.63% below its M/A (last close -3.83%)—Sell signal effective 10/11/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling.

Contact Ulli