ETF Tracker StatSheet

BULL-BEAR STRUGGLE

[Chart courtesy of MarketWatch.com]- Moving the markets

Bulls and bears were engaged in a tug-of-war during the entire session with the bulls showing strength early on but fading mid-day and briefly dropping into red numbers, as the bears gained the upper hand. In the end, the major indexes closed mixed and off the day’s highs with the S&P 500 and Nasdaq remaining in the red.

Today marked the 31st anniversary of the 1987 crash, which was also the period during which I fine-tuned my Trend Tracking Indexes (TTIs) to avoid participation in financial disasters like we saw at that time.

Markets were not influenced by that dubious anniversary but concerns about weak housing data and its potential fallout were weighing on traders’ minds. Existing home sales dropped for the 7th straight month and slumped 3.4% in August to a level last seen in November 2015, as Home-builder stocks collapsed. Considering the barrage of poor housing data sets we saw over the past week, there is bound to be some negative effect on GDP data, especially when considering the additional drag from the auto sector.

To be clear, it’s not just American car makers that are suffering, the Germans have joined the crowd. After BMWs recent tumble, it was Mercedes’ turn by warning that 2018 results would be “significantly” below prior year levels. Ouch!

In the end, the major indexes are clinging to key technical levels giving no clue as to any directional guidance. We are still at a point where either bears or bulls could be dominating, which means we will remain on hold with further commitments until the confusion clears.

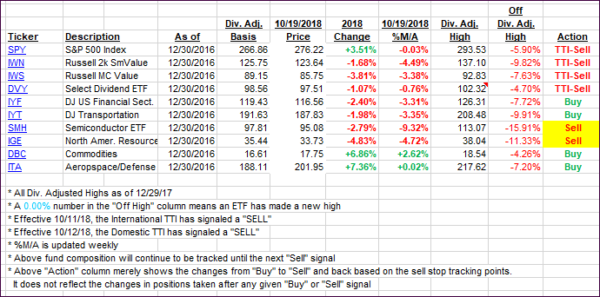

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) both headed further south and deeper into bearish territory. The Domestic one has now closed below its trend-line for the second straight day but, as mentioned yesterday, I’d like to see more staying power and further slippage before calling this one-week-old “Buy” cycle to be over. Right now, I consider its position to be still in the neutral zone.

Here’s how we closed 10/19/2018:

Domestic TTI: -1.45% below its M/A (last close -1.22%)—Sell signal effective 10/12/2018

International TTI: -3.36% below its M/A (last close -3.66%)—Sell signal effective 10/11/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & As

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli