- Moving the markets

A meager attempt of an early bounce was rebuffed, and the major indexes continued to head south towards bear market territory. I pondered yesterday whether the sell-off was overdone and might produce a quick rebound, or whether we were heading much lower and ending this bullish cycle.

The latter transpired as bouts of selling were interrupted by hopeful bounces, but the bears did not let up, and we dove into the close, just a tad off the session’s low point, as the chart above shows.

It was not just the US showing red numbers. Europe got hammered while the Asia indexes got crushed losing more than -3%, as China took the downside lead with -5.22%. Adding insult to injury was the fact that trading in some 1,000 Chinese companies was halted due to them hitting the 10% limit down rule. Ouch!

All of this is not surprising, as our International TTI already had crossed into bear market territory with the Domestic one now joining in. See section 3 below for more details.

In my advisor practice, I took the opportunity to liquidate most of our holdings, with the remainder being scheduled for tomorrow, unless I see a sharp rebound in the making. In that case, I will hold off for another day.

The ‘red’ October has clearly exacted a heavy toll with Transportations, Nasdaq and SmallCaps being down 9%—in only 9 trading days! The S&P has its own problem by not only being down for the 6th straight day in a row, but it has also sliced through its 200-day M/A for the first time since April.

Clearly, most technical indicators have been violated for most of the major indexes as well as for most of the sector ETFs. Some are now showing negative returns YTD, while for others, gains are quickly evaporating.

Interest rates eased a tad with the 10-year bond yield sliding 2.6 basis points to close at 3.14%. Consequently, the 20-year bond ETF (TLT) managed to close +1.22%, finally throwing an assist to those investors who hold TLT as a “risk” manager in their portfolios.

Does this mean that US markets are finally accepting reality by syncing up with the rest of the world? This chart seems to confirm that possibility, but if so, there is a long way to go.

The action of the past 2 days confirms the adage that “markets take the escalator up and the elevator down.” So, it’s quite possible that we will see a recovery, maybe by the end of this month that, after the mid-term elections, may very well accelerate and boost the S&P 500 to the 3,000 level by year-end as this fund manager seems to think.

Of course, before that happens, our Domestic TTI will have signaled a new “Buy,” which will let us participate in this year-end rally, should it materialize.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

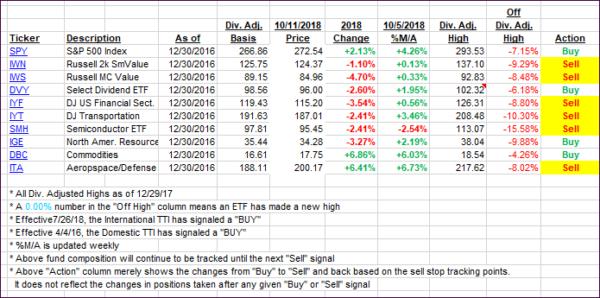

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) took another dive and settled in bear market territory. The Domestic one joined in and, as posted above, I will liquidate the remainder of our “broadly diversified domestic equity ETFs.” Should there be a rally in the making, I will hold off another day.

Here’s how we closed 10/11/2018:

Domestic TTI: -2.59% below its M/A (last close -0.38%)—Sell signal effective 10/12/2018

International TTI: -4.37% below its M/A (last close -2.27%)—Sell signal effective 10/11/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli

Comments 4

Hey, Ulli

I am compelled to take issue with your assertion today (10/16) that the market moved due to “…market manipulation.” You seem to see a conspiracy behind every upward move of the market. I’m sure you know that a short squeeze is a normal market reaction to a large up move, and is definitely not an indicator of “market manipulation.” May I put this in the selfsame category as your propensity to call a market gain in the midst of a bull market a “dead cat bounce?”

Smokey

10/16/18

Markets have been manipulated for the past decade. Call it QE 1, 2, 3 4 or various other acronyms, it’s still a fact. You have your opinion and I have mine… When I wrote today’s commentary, I was expecting a response from you… 🙂

Hhhmmm…well, I think I would call QE 1, 2, etc. economy manipulation as vs “market manipulation.” But as you said, you have your opinion…however, if I were as convinced as are you, I’d be much more reluctant to participate in the “market.”

Smokey

10/17/18

Yes, that’s why I only participate in the markets via a trend tracking strategy with clearly defined entry and exit points. That way, I have some means of control in a market that is uncontrollable…

Ulli…