ETF Tracker StatSheet

A CHOPPY END TO A GOOD MONTH

[Chart courtesy of MarketWatch.com]- Moving the markets

You could have pretty much counted on what happened today, namely that the major indexes vacillated aimlessly around their respective unchanged lines just to make it to the closing bell. While the Dow slipped a tad, the S&P 500 and Nasdaq ended in the green, but for the month, all three of them showed solid gains.

Never mind that the Emerging Markets’ bloodbath not only continued but spread to other currencies. Besides the weakness in the list of EMs I described yesterday, we saw a newcomer on the scene. The Indonesian Rupiah plunged to a two-decade low against the US Dollar, while Italy took a step in the limelight again with its 10-year bond getting hit hard as interest rate surged.

The Canadian dollar was in the spotlight indirectly and saw its currency slide as trade negotiators turned sour last night and were concerned whether a deal would be possible.

But, the focus continued to remain on other EMs, such as Turkey and Argentina, whose currency crises, if left to their own devices, will certainly have a domino effect across developed countries.

In the end, US stocks showed the greatest performance with especially the Nasdaq shining brightly by having its best August since the DotCom bubble, thanks to Apple and Amazon, which combined accounted for 25% of the entire Nasdaq gain in August. Talk a about a concentrated move…

This euphoric performance was helped by the biggest drop in bond yields since March leaving me pondering of the odds of this bullishness continuing as we enter the notoriously volatile months of September and October. Only time will tell…

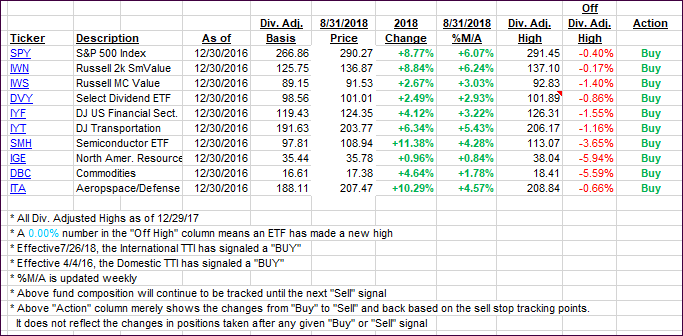

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) retreated as the last trading day of the month was mixed.

Here’s how we closed 08/31/2018:

Domestic TTI: +5.07% above its M/A (last close +5.26%)—Buy signal effective 4/4/2016

International TTI: -0.17% below its M/A (last close +0.47%)—Buy signal effective 7/26/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & As

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli