ETF Tracker StatSheet

AN UGLY ENDING

[Chart courtesy of MarketWatch.com]- Moving the markets

Despite Amazon showing some glow in its earnings report, it was not enough to bail out the weaklings, namely Netflix, Twitter and Facebook, which combined to pull the tech sector off its lofty level. Other bellwethers that disappointed were Exxon and Intel causing the major indexes to have a mixed week. The Dow and S&P 500 added 1.6% and 0.6% respectively, but the Nasdaq bucked the trend and lost 1.1%. SmallCaps (SCHA) joined the losers by surrendering 1.64%.

The GDP report came out showing an economy that grew at a 4.1% rate in the second quarter, which was the fastest pace in some 4 years. However, it did not please the Wall Street crowd whose expectations were 4.2%.

Personally, I have learned not to put too much credence in that first reading, since more times than not, this first estimate will be downwardly adjusted. In the meantime, however, this number will be taken as a sign that the Fed’s planned interest rate hikes will remain on schedule. On the day, the 10-year bond did not show much of a reaction with its yield slipping 2 basis points to close at 2.96%.

Amazon was the bright spot for the weak with its biggest quarterly profit in history, along with earnings that were twice of what was expected. Still, it was not enough to keep the tech sector from getting mauled throughout the week.

It remains to be seen if this week’s tech wreck can be repaired in the coming weeks, or if there is more fallout to come. Technically speaking, no damage was done to the QQQ ETF, but should it sink below its support line around 175, more downside risk may come into play. However, for right now, it maintains its position as a YTD performance leader.

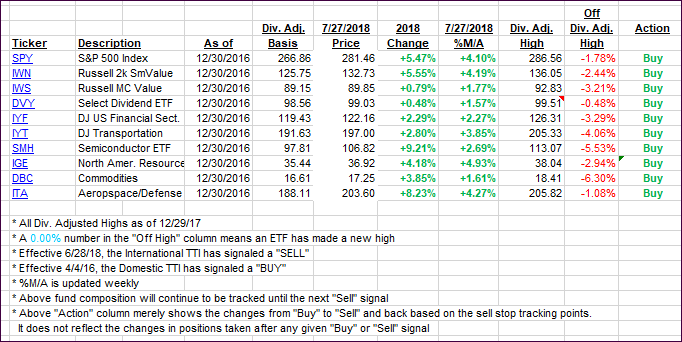

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) corrected with the overall markets. Despite this week’s volatility, there is no change in our holdings.

Here’s how we closed 07/27/2018:

Domestic TTI: +2.27% above its M/A (last close +2.82%)—Buy signal effective 4/4/2016

International TTI: +1.17% above its M/A (last close +1.44%)—Buy signal effective 7/26/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & As

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli