ETF Tracker StatSheet

GAINING FOR THE DAY, LOSING FOR THE WEEK AND CLOSING MIXED YTD

[Chart courtesy of MarketWatch.com]- Moving the markets

An early rally flamed out as money managers squeezed in some quarter-ending window dressing causing volatility to the up- and downside, as the major indexes barely edged out some green numbers.

With the first half of 2018 now in the books, things did not turn out very well when considering that global stocks lost over $10 trillion. This chart demonstrates the distribution of winners and losers with the latter clearly leading, while the major indexes showed a mixed picture.

Domestically, YTD, the Dow lagged with -1.8%, followed by the S&P 500 (+1.7%), only thanks to a 2-day rebound yesterday and today. Taking top billing were the Nasdaq (+8.8%) and the Russell 2000 with +7.7%.

On the global stage, it appears that things have calmed down, at least for the moment, with China reportedly easing restrictions on foreign investment in certain sectors. Today, the EU leaders announced a deal over the crisis of migration, a tug-of-war that had been especially hard fought by the embattled German chancellor Merkel.

We’re now facing the second half of 2018 and future market performance will depend on a variety of conditions. These questions are on my mind currently:

- Can the economy continue to grow, or will it start sputtering as some reports suggest?

- Will employment conditions stay healthy with inflation being offset by wage growth?

- Will intended interest rate hikes be absorbed by a sufficiently growing economy?

- Will an EU banking crisis occur (Black Swan event) and can it be contained before spreading across the Atlantic?

- Will inflation accelerate to a point where rates need to rise sharply and affect stock markets negatively?

While no one has the answers, one thing is for sure. The second half promises to be anything but boring.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

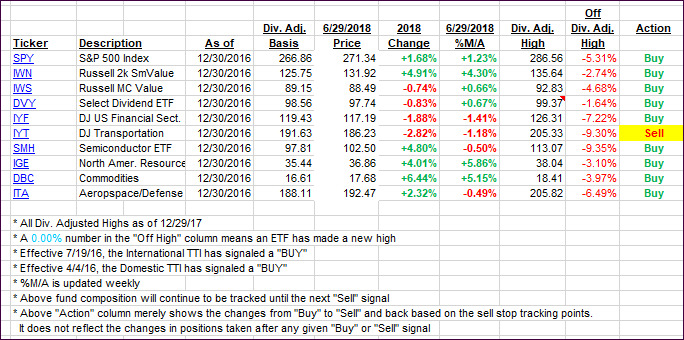

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) were mixed with the Domestic one losing and the International one gaining for a change.

Here’s how we closed 06/29/2018:

Domestic TTI: +1.45% above its M/A (last close +1.55%)—Buy signal effective 4/4/2016

International TTI: -1.20% below its M/A (last close -1.83%)—Sell signal effective 6/28/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & As

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli