ETF Tracker StatSheet

https://theetfbully.com/2018/02/weekly-statsheet-etf-tracker-newsletter-updated-02-08-2018/

RIDING THE ROLLER COASTER—AGAIN

[Chart courtesy of MarketWatch.com]- Moving the markets

The session started out with an early bounce that slowly but surely deteriorated, but some mysterious buyers stepped in late in the day to push the indexes back above their unchanged lines. It must have been bottom fishers, as the S&P 500 had just broken its 200-day M/A to the downside. Still, for the week, the markets posted their largest weekly drop since early 2016. The current chaos was spread widely with equity flows recording their biggest swing ever: Record inflow 2 weeks ago to record outflow from equity funds this week.

As the markets were starting to look dicey mid-day, I took the opportunity to liquidate those holdings (locking in a profit) that were on my list after having broken through their trailing sell stops. In my mind, there are only 3 things that can happen now:

- The markets continue to be chaotic and work their way lower by pushing our Trend Tracking Indexes into bear market territory. Should that happen, our sell stop exit strategy got us out in time before things got worse.

- The markets are indecisive and volatile and establish a sideways pattern with no clear direction in sight. However, eventually a break out, either up or down, will occur.

- The markets are finding a bottom here, and the major indexes resume their upward trend towards their old highs. In this case, the liquidation of our ETFs generated by our sell stop strategy was false and/or premature, and I will have erred on the side of caution. Having seen my share of market disasters over the past 30 years, I’d rather be a day early than a day late.

We will now have to wait and see if our remaining positions will get stopped out and if my 3 scenarios will start to play out next week.

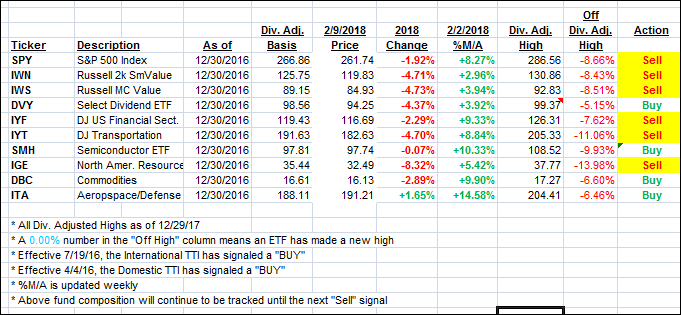

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) went south as the major indexes took a dive into the close.

Here’s how we closed 2/9/2018:

Domestic TTI: +1.48% above its M/A (last close +1.00%)—Buy signal effective 4/4/2016

International TTI: +1.21% above its M/A (last close +0.83%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & As

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli