ETF Tracker StatSheet

————————————————————-

————————————————————

Market Commentary

A RUMOR SAVES THE WEEK

1. Moving the Markets

I had to laugh out loud this morning when I saw the markets rallying predominantly supported by a rumor that Deutsche Bank (DB) is close to a $5.4 billion settlement with the US Justice Department (DOJ) as confirmed by the French Press (AFP). Recall that the “opening bid” was a penalty of over $14 billion a few weeks ago. That reduction served not only as the catalyst to pull DB’s stock price out of the basement for a gain of 14% but also supported the entire US equity market.

It’s laughable if we are to assume/believe that with this “discount” all of DB’s problems are resolved and the world’s most systemically dangerous bank no longer presents a threat to the banking system. To me, it looked more like a last minute assist by AFP to calm things down as Deutsche was facing severe outflows of cash while credit default swaps were soaring.

Monday is a banking holiday in Germany but depending on any further announcements by the DOJ over the weekend, or lack thereof, perception of reality may shift and cause another sell-off.

With Fed chief Yellen entertaining the possibility of the Fed potentially buying equities to keep markets propped up, none other than CNBC’s Rick Santelli resorted to 3 minutes of hard hitting truth by spilling his guts in this epic rant. It’s worth viewing.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

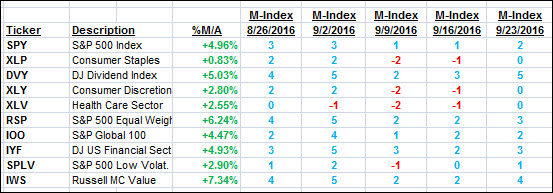

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

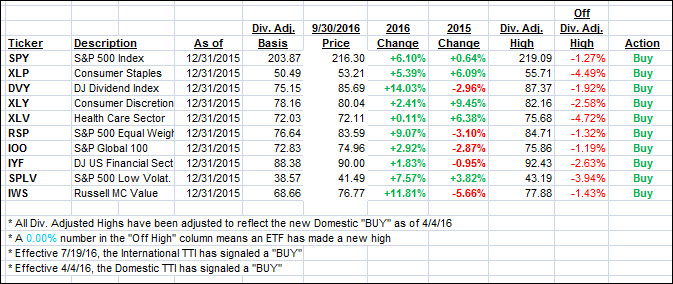

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Both of our Trend Tracking Indexes (TTIs) meandered during the week, did not make any headway but were in reversal mode.

Here’s how we closed 9/30/2016:

Domestic TTI: +2.38% (last Friday +2.48%)—Buy signal effective 4/4/2016

International TTI: +4.60% (last Friday +5.12%)—Buy signal effective 7/19/2016

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli