ETF/No Load Fund Tracker StatSheet

————————————————————-

————————————————————

Market Commentary

SECOND STRAIGHT WEEK OF GAINS UPON CALM FRIDAY

1. Moving the Markets

U.S. stocks ended mixed but posted a second straight week of gains Friday as oil prices basically held steady, China’s top central banker eased market fears and a report on U.S. economic growth showed the economy wasn’t quite as weak in the fourth quarter as previously thought (GDP revised from 0.7% vs. 1.0%).

Shares of Herbalife (HLF) rose sharply Friday after the embattled multi-level marketer of nutritional supplements disclosed it is in talks with the Federal Trade Commission to resolve an investigation of its marketing practices. The Los Angeles-based company’s stock closed 20.52% higher at $55.15.

Shares in Weight Watchers (WTW) went on a “diet” Friday, falling $4.54, or 29%, to close at $11.01 after the diet company said it expects a quarterly loss. Of course, Oprah was one of the biggest losers. Winfrey, the entertainment superstar, saw her massive, nearly 6.4 million-share stake in Weight Watchers shrink by almost $29 million.

Investors will be closely watching the G20 meeting of the world’s 20 major economies in Shanghai, where global leaders will discuss ways to jump-start weak economic growth around the world. As we’ve seen in the past, much jawboning will be going on very likely without any tangible results. Will this time be different?

No one knows but if not, we could see the major indexes shift back into reverse as hope reigns supreme that some form of stimulus will come out of these meetings.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

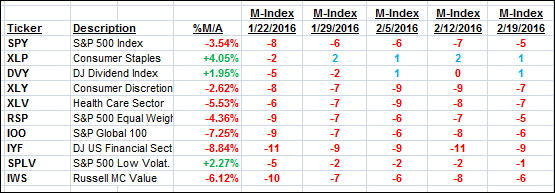

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

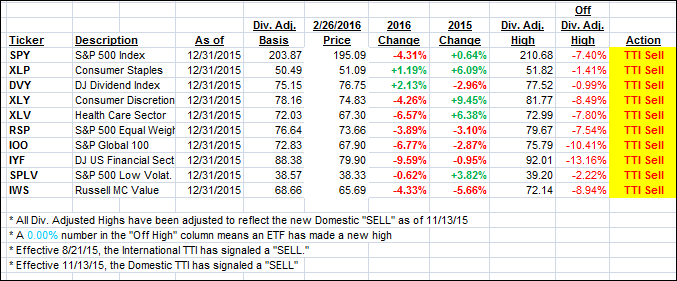

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) declined as the bear market rebound continued its biggest 2-week short squeeze since October 2011.

Here’s how we closed:

Domestic TTI: -1.27% (last Friday -2.04%)—Sell signal effective 11/13/2015

International TTI: -7.93% (last Friday -9.19%)—Sell signal effective 8/21/2015

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli