1. Moving the Markets

Well, the trading month of August was a wild ride for us all. August 2015 chalked up to be the worst month for the Dow since May 2010 and the stock market’s first 10% correction in four years. Investors remained nervous over fears of a move by the Fed to raise rates and stocks followed a global market selloff sparked by a weak manufacturing report out of China that raised fresh fears of a worsening slowdown in the world’s second-biggest economy.

The first trading day in September did nothing to ease fears on Wall Street. The Dow plunged 470 points and all indexes closed down nearly 3%. Sparking the negative market sentiment today was a report released overnight which showed that manufacturing in August in China hit a three-year low, exacerbating worries about the health of the world’s second-biggest economy and sparking fresh fears of a global growth slowdown.

Perhaps some positive news for those investors in food chains is that America’s Mexican-on-the-go powerhouse Chipotle (CMG) is rolling out a delivery service to universities. Chipotle has partnered with Tapingo, a food-delivery app specifically for the college market, to deliver its burritos, bowls and other menu items to 40 college campuses, the fast-casual chain said today. It will expand to more than 100 campuses by spring. Guacamole anyone?

For the second day in a row, there were no winners among our 10 ETFs in the Spotlight as the bear remained clearly in charge. It turned out to be a good time to be on the sidelines with all sectors getting clobbered. Taking the biggest spanking was the Global 100 ETF (IOO) with -3.18%, while Consumer Staples (XLP) “only” lost -2.05%.

That’s no surprise to us, as our Trend Tracking Indexes (TTIs) continue to be stuck below their trend lines and therefore in bear market territory. Please see more details in section 3.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

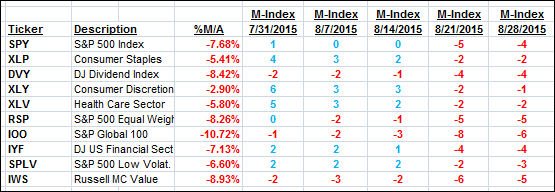

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

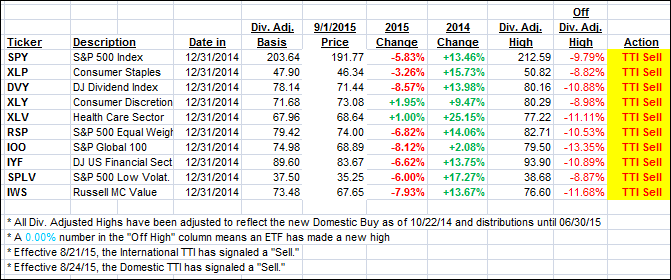

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Both of our Trend Tracking Indexes (TTIs) confirmed again our bearish position as they slipped deeper into bear market territory.

Here’s how we ended up:

Domestic TTI: -3.11% (last close -1.87%)—Sell signal effective 8/24/2015

International TTI: -6.99% (last close -4.69%)—Sell signal effective 8/21/2015

So, what could turn this bear market around quickly? Well, for one a repeat performance from last October by one of the Fed Govs talking about a new Quantitiative Easing program could do it. Or, a new plan along the same lines announced by ECB head Draghi might do the trick. Let’s wait and see what efforts are being made to pump the markets back up.

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli