1. Moving the Markets

Stocks surged again as Wall Street built on the Dow’s historic rally Wednesday. Order is now allegedly restored in the U.S. stock market following its first dip into correction territory in four years. Investor angst is on the decline and stock prices were again on the rise following the Dow’s nearly 620-point, 4% gain Wednesday, a much-needed and hoped for rebound that restored a sense of stability to a nervous market following a nearly 15% drop for the blue-chip stock gauge from its May 19 high.

Pushing the rally forward were fresh signs that the U.S. economy is still powering on despite slowing growth in China, including a strong revised reading released today on second-quarter GDP, which came in at 3.7%, up from an initial estimate of 2.3%, and comments from a Federal Reserve member Wednesday that pointed out that the reasons for a September interest-rate hike were “less compelling” following the recent market turbulence caused by China’s growth scare. I mentioned earlier in the week that chances were good that a Fed member might jawbone the markets higher similar to October last year; and they did not disappoint.

While this rebound has a a little ways to go before we can declare this bearish period to be in the rear view mirror, odds are high that volatility is still with us and bearish forces could take over again quickly. We’ll have to wait and see how things play out until we have clear evidence that the bull is still alive and kicking before making new commitments to the market.

For the second day in a row, all of our 10 ETFs in the Spotlight participated in the rebound and closed higher. The leader of the day was the Mid-Cap Value ETF (IWS) with +2.95%; lagging the bunch was Consumer Staples (XLP) with a more modest gain of +1.38%.

Despite two days of sharp rallies, our TTIs remain on the bearish side of their trend lines as you can see in section 3 below.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

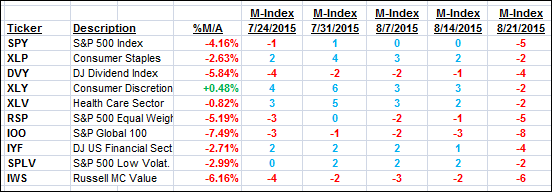

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

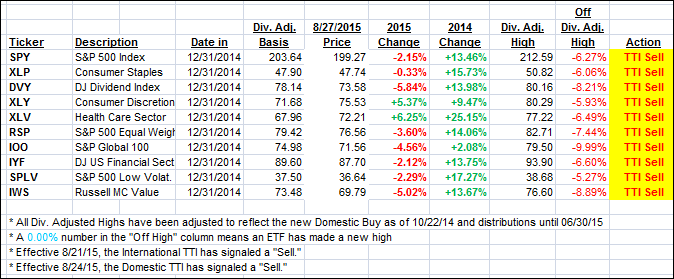

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column. Overriding the sell stop will be a break of the Trend Tracking Indexes (TTIs) below their respective trend lines, a condition which we have now reached.

3. Trend Tracking Indexes (TTIs)

While our Trend Tracking Indexes (TTIs) improved their positions relative to their respective long-term trend lines, they remain in bear market territory by the following percentages:

Domestic TTI: -1.46% (last close -2.45%)—Sell signal effective 8/24/2015

International TTI: -4.42% (last close -5.79%)—Sell signal effective 8/21/2015

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli