Somehow negative economic releases helped U.S. equities rise on Thursday, rebounding from the previous session’s losses, as tepid economic data eased concerns the Federal Reserve would begin to gradually scale back its policy of stimulating growth.

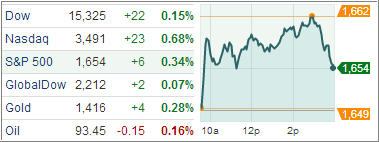

The Dow Jones Industrial Average gained 22 points (0.2%) to 15,325, the S&P 500 Index advanced 6 points (0.4%) to 1,654, and the Nasdaq Composite increased 24 points (0.7%) to 3,491.

Stocks opened with early gains with six of ten sectors ending in the black as financials and technology paced the broad market gains. Biotechnology constitutes a good portion of the health care sector, which outperformed its defensively-oriented peers. Another defensively-minded group, utilities, was up as much as 2.0% in early action before surrendering the bulk of its gains to settle up 0.2%.

The morning rally took place after NV Energy agreed to be acquired by Berkshire Hathaway’s MidAmerican for $23.75 per share, representing a 23.2% premium to yesterday’s closing price. Despite ending in the black, the utilities sector remains the weakest performer of the month, down 9.0%.

In economic news, initial claims for unemployment insurance picked up 10,000 last week to 354,000, contrary to expectations for no change at 340,000. Continuing claims for unemployment insurance rose 63,000, the most in five months, to 2.986 million, while the insured jobless rate was unchanged at 2.3%.

Both measures continue to trend lower on a four-week average basis, reaching their lowest levels since the summer of 2008. Meanwhile, the second look (of three) at 1Q Gross Domestic Product, the broadest measure of economic output, showed a quarter-over-quarter decline by 0.1 percentage point to a 2.4% annual rate in Q1, in line with the consensus. Growth in this recovery remains subpar, below the average historical rate of 3.2%. Lastly, pending home sales for April rose 0.3%, which was worse than the consensus of a 1.7% gain. Today’s reading follows last month’s rise of 1.5%.

Late afternoon selling erased earlier gains following a headline from Nikkei news, indicating Japan’s plans to impose new foreign exchange margin trading rules. The news caused dollar/yen to slip into the red while also weighing on equities.

Stocks have been volatile recently and closely tied to alternating views of the future of the Fed’s loose monetary policy. As I posted many times, the market has been driven largely if not exclusiuvley by the Fed’s policy.

Equity futures retreated as much as 0.4 percent earlier today as Japan’s Topix sank 3.8 percent to extend losses from its May 22 high to more than 10 percent, the threshold for a correction. Is the U.S. market at risk if that pullback continues?

That is the big question as conservative indexes, such as consumer staples, have shown unusual volatility while higher beta indexes, such as the S&P 500, have demonstrated more upside strength. This could change in a hurry depending on the perception of what the Fed will do next. Consequently, it’s best at this time to sit tight and let the sell stops be the guide dictating the next change in positions.

Our Trend Tracking Indexes (TTIs) recovered from yesterday’s drubbing and edged slightly higher with the Domestic TTI ending at +3.95% and the International TTI closing at +8.46%.

I will post the latest StatSheet, featuring updated charts and momentum figures, a little later on this evening.

Contact Ulli