Major Market ETFs retreated today with the S&P 500 climbing down from a four-year high as optimism over the European Central Bank’s possible intervention to limit the region’s contagion was eclipsed by a decline in US equities led by technology stocks.

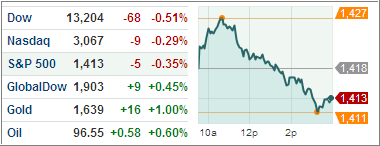

The Dow Jones Industrial Average (DJIA) fell 0.5 percent, with 22 of the 30 stocks within the index ending in the negative territory. Both, the S&P 500 Index (SPX) and the tech-laden NASDAQ Composite (COMP) retreated, losing 0.4 percent and 0.3 percent respectively.

Investors sought refuge in safe-haven assets, pushing yields of Treasury 10-year notes down during the session after a slump in equities fueled worries whether EU leaders would move fast enough to arrest the region’s debt crisis.

Risk sentiment got a boost earlier amid reports that a senior lawmaker from the German ruling coalition said Tuesday concessions are possible for Athens as long as the country shows willingness to stick to bailout linked austerity targets.

The euro rose one percent against the greenback Tuesday amid hopes that the European Central Bank would target capping borrowing costs for Italy and Spain. The dollar index, a barometer of the USD’s strength against a basket of six currencies, dropped to 81.939 – its lowest level since early July, from 82.475 in late Monday trade.

European stocks advanced Tuesday with mining and banking shares leading the rally amid hints China may offer further monetary stimulus soon, and the ECB would intervene to address the EU debt crisis. Whether they will actually come up with an executable plan or just use empty jawboning again to keep stock markets at elevated levels remains to be seen.

The benchmark Stoxx Europe 600 index rose 0.4 percent after a late-Monday report in UK’s Daily Telegraph claimed ECB officials are examining plans to cap borrowing costs for Spain and Italy.

Banking stocks buoyed UK’s FTSE 100 index after Joerg Asmussen, a German board member of the ECB’s executive board, backed the central bank’s plan to purchase bonds. Another market moving event in the short term could be Greek Prime Minister Antonis Samaras’ meeting with German Chancellor Angela Merkel in Berlin Friday. Samaras will travel to Paris Saturday to meet French President Francois Hollande. The Greek PM is expected to seek a four-year time frame to meet austerity targets rather than the two agreed earlier.

The ECB, however, has made it very clear that it’s unlikely to intervene unless Spain and Italy officially request help from the region’s bailout fund and agree to adhere to strict policy conditions involving structural reforms and budget cuts.

In the ETF space, gold linked funds rallied after the yellow metal gained $19.90 to close at $1642.90 in the futures market amid hopes monetary stimulus from the ECB.

Miners, however, led from the front with the Global X Gold Explorers ETF (GLDX) rising 3.67 percent on the day. The Van Eck Market Vectors Junior Gold Miners ETF (GDXJ) and the Van Eck Market Vectors TR Gold Miners (GDX) also made impressive gains, rising 3.42 percent and 1.67 percent, respectively.

Silver miners also made significant gains with the Global X Silver Miners ETF (SIL) adding 2.75 percent as we approach the seasonally strong demand period for gold and silver starting from September through March.

I have made several adjustments to our model portfolios, which I will post tomorrow morning.

Disclosure: No holdings

Contact Ulli