ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, August 26, 2011

ONE WEEK DOES NOT MAKE A MONTH

Finally, after 4 weeks of losses, the major market ETFs managed to pull out a win, although it was marked by the usual amount of volatility during which the bears easily could have taken over. Nevertheless, this week, the bulls prevailed.

With only 3 trading days left in the month of August, the markets will have to take off in a straight line to make up the S&P’s monthly loss of -8.90%.

Today was not smooth sailing, despite the close to the upside, as the Dow swung wildly within a 352 point trading range. Stocks got hammered early on during the Bernanke speech after which the rebound started, and we went straight up from there.

With Bernanke not making any new stimulus commitment, and postponing any further action until the September meeting, the markets really had nothing to go by. Although, to me it seems that a lot of shorts were caught having to cover as the markets headed higher, which may have contributed to this strong rebound.

Not helping was the revised 1% GDP second quarter estimate (down from 1.3%), which confirms the economy is stalling at best, and this year’s growth is the worst since the recovery began in mid 2009. Additionally, consumer sentiment fell to its lowest level since November 2008 supporting my long held view that the consumer is very concerned about the state of economic affairs.

Our Trend Tracking Indexes (TTIs) improved their positions and are hovering above and below their respective trend lines as follows:

Domestic TTI: +0.69% (last week -0.99%)

International TTI: -10.03% (last week -12.33%)

As you can see, the international TTI remains stuck in bear territory, while its domestic cousin has perked up again and continues to do the trend line dance: A little above and a little below with no clear direction yet. I maintain my bearish stance until an obvious break in either direction becomes apparent.

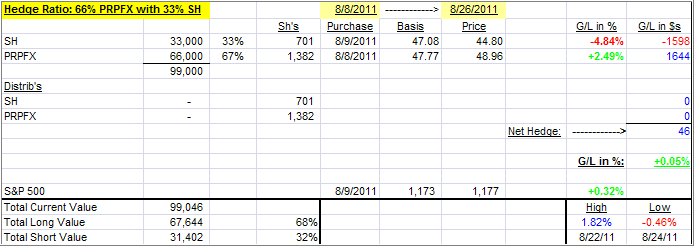

Our PRPFX hedge has remained neutral, as it is supposed to be. Here’s the current matrix:

With the benefit of hindsight, we could have done well without it, since the markets did not really tank, from the time I initiated the hedge on 8/9/11. On that day, the S&P 500 closed at 1,173 and today, the index reached 1,177.

However, if the markets do another swan dive imitation, and there’s a good chance of that (I just don’t know the timing of it), we’ll be in a better position to take advantage of that drop. Remember, this particular type of hedge does much better when markets head down than when they rally.

However, if we continue to inch higher, I will remove the SH component of the hedge as PRPFX by itself has proven to be a formidable fund for most market conditions when used with my recommended trailing stop loss discipline.

Have a great week.

Ulli…

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader Andy:

Q: Ulli: Thanks as always for the great advice and stop loss strategy.

I wanted to get your thoughts on a possible Portfolio #8 for the aggressive investor. This would essentially be a bear portfolio where the same principles are applied, but to a down market with a “negative” TTI. This portfolio would consist of various 1x inverse funds (SH, etc.). The same stop loss strategy would be applied, and positive funds could be used as a hedge, when deemed applicable.

There is money to be made in the bear market, so I wanted to see what you thought of jumping in with this Portfolio 8 as opposed to sitting on the sidelines (outside of PRPFX/SH portfolio, which I am currently using) until a positive trend is re-established.

A: Andy: No, I am not in favor of most investors going that route. Yes, while there are rewards playing the short side of the market, the volatility and extreme sharp market rebounds can turn this more into a casino atmosphere than an investment environment. As such, I believe it’s only suitable for those with a high risk tolerance.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli