In my recent post about the potential Chinese bubble, reader Ron responded that stock markets can’t be controlled by governments.

In my recent post about the potential Chinese bubble, reader Ron responded that stock markets can’t be controlled by governments.

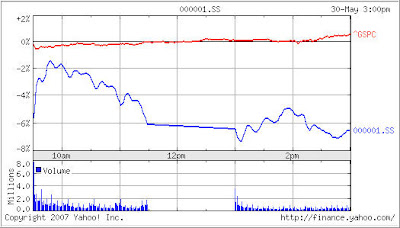

While that may be true, government decisions or policy changes, however, can be just as effective in controlling market direction. Such was the case yesterday when the Chinese government announced a tripling of the tax on stock trading to curb excessive speculation. The response was swift as the Shanghai Index lost 6.5% for the day.

Most world markets joined in the early sell off, but recovered later on and, in the case of the S&P; 500, a new lifetime high was made. The chart below shows yesterday’s price activity of the Shanghai Index vs. the S&P; 500:

While there could be many reasons, I think one of them is that it is now almost expected that the Chinese market at one point in the future will correct sharply. Wall Street tends to react more kindly to anticipated events as opposed to sudden surprises.

Second, the release of the minutes from the last Fed meeting gave the bullish crowd further ammunition to push the major indexes higher. The minutes said that, although housing weakness continues to go on for longer than expected, the SubPrime markets appear to have been relatively stable.

Comments 1

Hey, I’m famous now! 😀

My reading of the event you wrote about is that other markets didn’t think the dramatic drop really had anything to material to do with the Chinese economy itself. Just the A shares that we can’t participate in anyhow and known to be an immature market. If a big drop happens that was precipitated by indications things aren’t rosy in the Chinese economy then watch out. Automated systems will be triggered turning off trading temporarily in markets all over the world.

If I recall I think my comments were directed at the two Chinese sisters that were convinced they gov’t wouldn’t let prices fall before the end of 2008. I still don’t think they have that kind of control beyond their policy of turning off trading if the market hits -10% (I believe that’s policy there), but this also proves the women wrong. They haven’t considered that they gov’t might actually WANT to depress prices to some extent which any gov’t can do at any time through a variety of means. The gov’t just can’t prevent investors from hitting the doors all at once due to some event outside it’s control of which there are too many to mention…