- Moving the markets

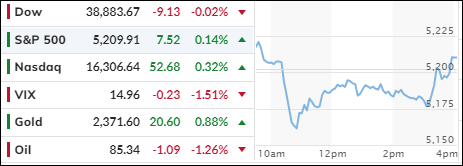

Today’s stock market witnessed a remarkable turnaround, with technology stocks leading the charge. The earlier concerns about ongoing inflation were overshadowed as tech giants like Nvidia soared nearly 4%, while other prominent players such as Amazon and Alphabet each advanced over 2%. Amazon’s shares reached unprecedented heights, and Apple enjoyed its most significant gain of the year with a 3% increase.

The Producer Price Index (PPI) for March reported a modest rise of 0.2%, falling short of the 0.3% predicted by economists, which eased some of the tension following Wednesday’s sell-off triggered by an unexpected surge in consumer goods and service prices. The Core CPI, excluding food and energy, also rose by 0.2%, aligning with expectations.

Despite this, New York Fed President John Williams’ remarks today suggested no immediate policy shifts, a stance that may dishearten traders looking for more aggressive action.

In the wake of a higher-than-anticipated Consumer Price Index (CPI) for March revealed on Wednesday and Federal Reserve meeting minutes indicating ongoing concerns about reaching the central bank’s 2% inflation target, it appears traders are adjusting their outlook. The realization is setting in that taming inflation may be a more formidable challenge than previously thought.

The buying frenzy wasn’t limited to the ‘Magnificent Seven’; gold, the recent favorite among investors, also experienced a surge, hitting a new all-time high of over $2,370.

As we close another tumultuous trading session, the financial community turns its attention to the upcoming earnings season. With major banks poised to disclose their first-quarter results tomorrow, one can’t help but wonder:

Will the big banks’ earnings reflect the resilience seen in today’s market comeback?

Read More