ETF Tracker Newsletter For March 6, 2026

ETF Tracker StatSheet

You can view the latest version here.

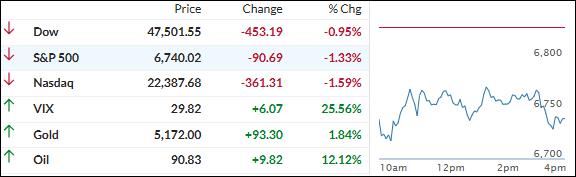

WEAK JOBS REPORT + OIL SPIKE – STOCKS SLIDE, MAG 7 HOLDS FIRM

- Moving the market

Stocks opened lower and stayed soft all day, adding to their weekly losses as oil prices spiked higher and traders digested a surprisingly weak February jobs report.

Nonfarm payrolls dropped by -92,000 (a big miss vs. the expected +50,000 gain), with the unemployment rate ticking up to 4.4% from 4.3%. Ouch! That soft labor data, combined with persistent inflation concerns, kept the risk-off mood alive.

West Texas Intermediate crude broke above $89 a barrel, and Brent traded over $91 as worries grew about potential supply disruptions from the ongoing U.S.-Iran conflict.

Higher energy costs are putting more pressure on consumer spending and complicating the Fed’s rate decisions—soft jobs + sticky inflation isn’t the Goldilocks scenario anyone wants.

The Mag 7 actually outperformed the rest of the S&P 493 this week, acting almost like a safe-haven flow alongside the dollar (which held firm).

Bond yields spiked but backed off their highs today. Precious metals had a choppy week overall—treading water after Monday/Tuesday’s sell-off—but gold found support around $5,000 and swung sideways.

Silver lagged, and Bitcoin ended the week basically unchanged after hitting highs midweek.

Traders are now wondering if oil heads toward $100 next week and what kind of reckoning stocks might face if history repeats.

Read More