ETF Tracker StatSheet

https://theetfbully.com/2017/08/weekly-statsheet-etf-tracker-newsletter-updated-08032017/

JOBS NUMBERS BETTER THAN EXPECTED

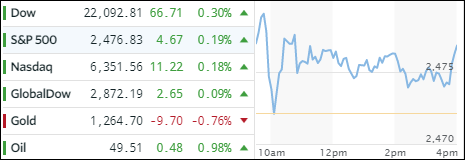

[Chart courtesy of MarketWatch.com]- Moving the Markets

Again, bouncing around in a tight range was the theme of the day, but the major indexes managed to close in the green with the Dow ending at a record for the 8th straight day. The main supporting actor was not only the headline report of 209k jobs being added vs. an expected 180k, but also June’s revision higher to 231k from 222k. The month of May, however, was revised lower from 152k to 145k.

Under the hood, when looking at the quality of jobs, not much has changed from the prior months; the sector adding the most was the “waiters and bartenders” category with +53,000, its highest monthly increase since March 2014. It remains the strongest sector for US employment. As ZH reports, ‘there have now been 89 consecutive months without a decline for waiter and bartender jobs.’ Hardly a sign of a healthy and growing economy…

On the other hand, to heck with reality, all that matters is the perception that the economy is growing. Consequently, bonds dropped with the 10-year yield rising 3 basis points to settle at 2.27%. Gold got pushed down, as the Dollar Index (UUP) did its best imitation of a dead cat bounce intra-day, traded in a wide range but faded into the close with a gain of +0.87%.

Despite the tight trading range, all of our holdings closed higher, led by Transportations (IYT) with +0.77%. This was closely followed by SmallCaps (SCHA), which added +0.45% on the day.

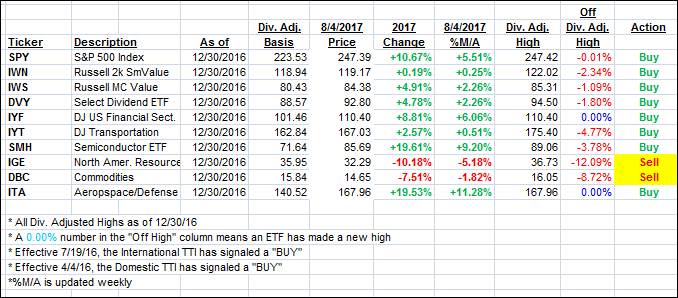

- ETFs in the Spotlight (updated for 2017)

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the 2017 candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) slipped a tad despite the major indexes closing in the green.

Here’s how we closed 8/4/2017:

Domestic TTI: +3.03% (last close +3.16%)—Buy signal effective 4/4/2016

International TTI: +7.92% (last close +8.35%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli

Comments 1

Looking a little deeper into the consistent jobs gains in the “waiters and bartenders” category, one might conclude that people are confidently spending money on entertainment. An individual with a different view of the market from your newly found go-to source ZH (permabears), might find that increase to be encouraging.

Smokey

8/4/17