In honor of the Donald’s “Mother of All Bomb” (MOAB) attack on the Hindu Kush mountains Thursday, let me introduce MOAD.

I’m referring to the “Mother of All Debt” crises, of course. The opening round is coming when Washington goes into shutdown mode on April 28, which happens to be Day 100 of the Donald’s reign.

In theory, this should be just a routine extension of the fiscal year (FY) 2017 continuing resolution (CR) by which Congress is funding the $1.1 trillion compartment of government which is appropriated annually.

The remaining $3 trillion per year of entitlements and debt service is on automatic pilot, but the truth is Washington can’t agree on what to do about either component — except to keeping on borrowing to pay the bills.

There is a problem with this long-running game of fiscal kick-the-can, however. Namely, a 100 year-old statute requires Congress to raise the ceiling for treasury borrowing periodically, but the Imperial City has now reached the point in which there is absolutely no way forward to accomplish this.

Moreover, that critical fact is ill-understood by Wall Street because it does not remotely recognize that all the debt ceiling increases since the public debt exploded after the 2008-09 crisis were an accident of the Obama presidency.

That is, surrounded by Keynesian economic advisers and big spending Democratic politicians, he had no fear of the national debt at all and obviously even believed the more debt the better.

And Obama was also able to bamboozle the establishment GOP leadership led by former Speaker Boehner into steering enough GOP votes to the “responsible” course of action.

Needless to say, Obama is gone, Boehner is gone and the 17-month debt ceiling “holiday” that they confected in October 2015 to ride Washington through the election is gone, too. What’s arrived is vicious partisan warfare, a new President who is clueless about the urgency of the debt crisis and a bloc of 50 or so Freedom Caucus Republicans who now rule Washington.

And good for them!

They genuinely fear and loathe the banana republic financial profligacy that prevails in the Imperial City, and would rip the flesh from Speaker Ryan’s face were he to go the Boehner route and try to assemble a “bipartisan” consensus for a condition-free increase in the debt ceiling.

What that means is a completely new ball game in the Imperial City that will absolutely dominate the agenda as far as the eye can see. That’s because the Freedom Caucus will insist that sweeping entitlement reforms and spending cuts accompany any debt ceiling increase.

Even “moderate” Senator Rob Portman (Ohio) has legislation requiring that dollar for dollar deficit cuts accompany any increase in the debt ceiling.

But if you think the GOP fractures and fissures generated by Obamacare replace and repeal were difficult, you haven’t seen nothin’ yet. There is absolutely no basis for GOP consensus on meaningful deficit cuts, meaning that MOAD will bring endless starts, stops, showdowns and shutdowns, as the U.S. Treasury recurringly exhausts its cash and short-term extensions of its borrowing authority.

In the meanwhile, everything else — health care reform, tax cuts, infrastructure — will become backed-up in an endless queue of legislative impossibilities. Accordingly, there will be no big tax cut in 2017 or even next year. For all practical purposes Uncle Sam is broke and his elected managers are paralyzed.

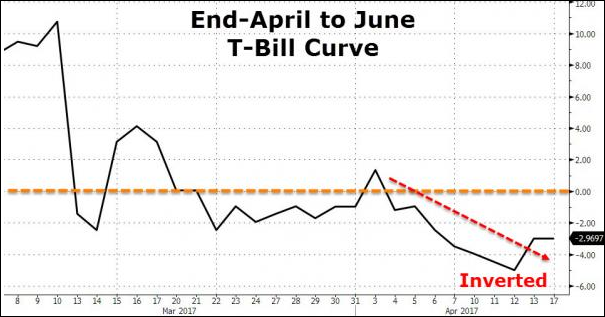

The Treasury will be out of cash and up against a hard stop debt limit of $19.8 trillion in a matter of months. But long before that there will be a taste of the Shutdown Syndrome on April 28 owing to the accumulating number of “poison pill” “riders” to the CR.

These include the virtual certainty of riders to the House bill to “defund” Planned Parenthood and sanctuary cities. Other extraneous amendments will also possibly include funds demanded by the White House to start the Mexican Wall, enhance deportations and fund some of Trump’s $54 billion defense increase.

By contrast, the Senate Democrats will move heaven and earth to attach mandatory funding for upwards of $7 billion to fund Obamacare, screaming that without these funds massive new premium increases will be needed and/or more insurance companies will withdraw from the Obamacare exchanges next fall.

Unfortunately, such rank demagoguery will almost surely gather considerable support from squishy middle-of-the-road Republicans like Susan Collins and Lisa Murkowski.

To be sure, none of these riders have much to do with the mutli-trillion deficit and debt ceiling crises ahead, but they are just as toxic politically.

So when they close down for several days the Washington monument owing to an inability to reach agreement on a trivial $70 million annual funding item for family planning services — the equivalent of nine minutes of annual Federal spending or something that Bill Gates could fund out of his cash drawer — it will not only come as a shock to Wall Street.

It will also embody a warning that there is no consensus on anything or any real semblance of functioning government in Washington, and that as these battles accumulate the degree of dysfunction will only intensify.

Meanwhile, there is another shock heading toward the canyons of Wall Street. Namely, that this so-called recovery is finally running out of gas. I have no use for the seasonally maladjusted and endlessly manipulated, massaged and revised data that come out of the Washington statistical mills.

By contrast, the data that comes out of Uncle Sam’s revenue farebox is an altogether different kettle of fish. That is, no employer in America is paying withholding taxes on payroll slots that do not exist or sending in estimated taxes on profits that are not happening.

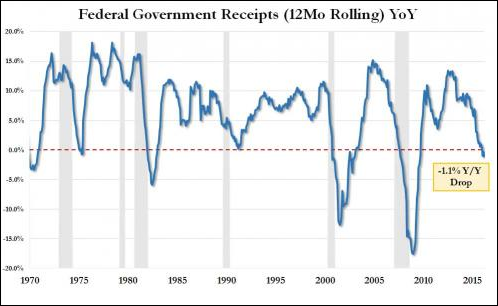

Yet after six months of FY 2017 has elapsed, two things are quite evident. First, Federal receipts in March were down on a year over year basis (12 month moving average) for the fourth straight month. The so-called recovery has deflated completely and receipts are now heading lower in the manner that has accompanied prior recessions.

Secondly, the deficit is once again rising rapidly. During the first six months of this fiscal year it totaled $527 billion compared to $459 billion last year, thereby representing a 15% year-over-year gain. And that is something new on the scene, as well.

The kick-the-can fiscal game of the last eight years was enabled originally by Washington’s false fears of Great Depression 2.0 generated during and after the financial crisis by Ben Bernanke and former Treasury Secretary Hank Paulson.

And after the crisis passed, by the glib belief that the Federal deficit was steadily falling and would cure itself with the passage of enough time.

That delusion is now off the table — at least among the Freedom Caucus Republicans who rule the roost. So again, the consequence will be a hardening of the lines of battle around MOAD in a manner that has never before been seen in the Imperial City.

As I told Fox Business the other day, it is a stark warning to get out of the casino before it’s too late.

Even if you are not troubled by the outbreak of hostilities at hotspots all around the planet or not inclined to fret about the shocking fact that the Fed is actually contemplating shrinking its balance sheet for the first time in essentially three decades, there is still this:

The U.S. economy is sliding toward recession and the chances that the “stimulus” baton will be handed off to ballyhooed Trump Reflation are lower than those of the proverbial snowball in the hot place.

On April 28, reality is likely to come breaking in and finally shatter all remaining delusion.

Contact Ulli