- Moving the Markets

One of the funnier headlines I’ve seen in a while was featured by a Bloomberg writer, who in a note titled “Still No Details as Trump Makes America Wait Again” opined that, while the market was surging on a sugar high this morning, no details on how Trump plans to achieve his lofty goals were given.

Here’s the full note:

The longer the market has to process Trump’s speech, the less impressed it’ll be. It was rhetoric packed with hopes and dreams, but light on details and concrete plans.

Sadly, it feels like this outcome was all too predictable. Although, the possibility that he could have surprised us all means that the market has not yet fully priced in today’s disappointment.

Trump did manage to sound presidential and statesmanlike, and avoid getting bogged down in partisan or petty attacks. This is a positive.

It’s also supportive that infrastructure returned to the core of the agenda. Although, it seemed a resurrection of vague plans from three months ago rather than a step further along the path to implementing a program.

Financial bubbles, most notably the dotcom era, have proven that hopes and dreams can keep the market irrational longer than most of us can remain solvent.

At some point though, reality catches up. And 40 days in to Trump’s administration, there’s little sign that he’ll deliver much of a boost to the U.S. economy on any imminent horizon.

Optimistic soundbites from the speech don’t have the ability to drive the market higher on a sustainable basis. As analyst notes flow in to investors’ inboxes during the next 24 hours, asset prices may start reflecting a far more negative outcome.

Beware downside moves in the dollar, in U.S. yields, and even in equities. At some point, traders may realize the new emperor has no clothes.

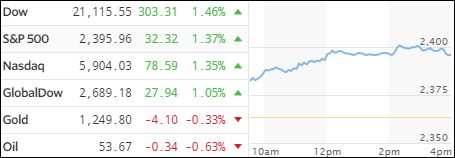

While his view may turn out to ultimately be correct, right now the markets were surging to new all-time highs. A lot of support came from the bearish Wall Street crowd which had, in anticipation of a negative market reaction from Trump’s speech, engaged in setting up huge short positions that needed to be covered in a hurry this morning thereby supporting the bullish cause.

To me, today’s entire ramp had the smell of a “blow-off” top to it but, for the time being, upward momentum rules, and we will stay on board for the ride.

- ETFs in the Spotlight (updated for 2017)

In case you missed the announcement and description of this section, you can read it here again.

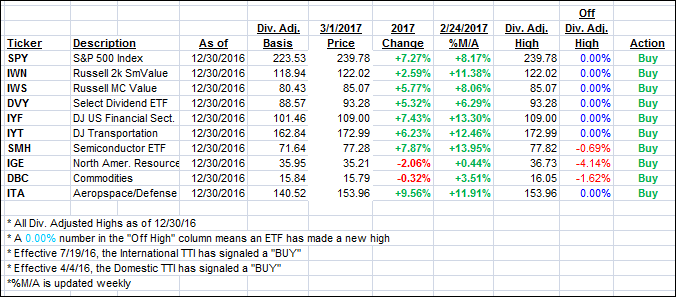

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the 2017 candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) jumped higher as the bulls clearly ruled the day.

Here’s how we closed 3/1/2017:

Domestic TTI: +3.30% (last close +2.78%)—Buy signal effective 4/4/2016

International TTI: +6.00% (last close +4.91%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli