ETF Tracker StatSheet

https://theetfbully.com/2017/03/weekly-statsheet-etf-tracker-newsletter-updated-03232017/

HEALTH CARE BILL FAILS; MARKETS SINK

[Chart courtesy of MarketWatch.com]- Moving the Markets

In a repeat performance of yesterday, an early rally stalled and reversed leaving the major indexes about unchanged for the day but down for the week with the S&P 500 surrendering some -1.4%.

As I mentioned throughout the week, the most widely watched news event was the path of the health care bill and whether Trump could muster enough votes in his own party to get the legislation through congress. The answer was finally revealed, before the markets closed, as Republicans pulled the bill prior to the voting procedure admitting that it could not get passed in its present form.

That leaves the question as to what market reaction might be come next week. On view is that this is an ominous sign for Trump’s ability to push through his economic agenda while, on the other hand, you could argue that, with this monkey off his back for the time being, other things that are not as complicated like lowering taxes and reducing regulations, might be more doable.

Market internals looked like this: This is the Dow’s longest losing streak (7 days) since election. Small Caps had their worst week since February 2016. The S&P 500 had its worst five trading days since November while the Financials suffered their worst week since January 2016.

The greenback continued its slide for the 8th losing day in a row, which is the longest losing streak for the Bloomberg Dollar Index since April 2011. Treasury yields dropped on the week, despite the Fed’s rate hike on 3/15, which gave bond investors a reason to cheer as bonds finally rallied. Gold was the winner again, and the precious metal is now up for 2 weeks in a row, its best 2-week period since Brexit in 2016.

- ETFs in the Spotlight (updated for 2017)

In case you missed the announcement and description of this section, you can read it here again.

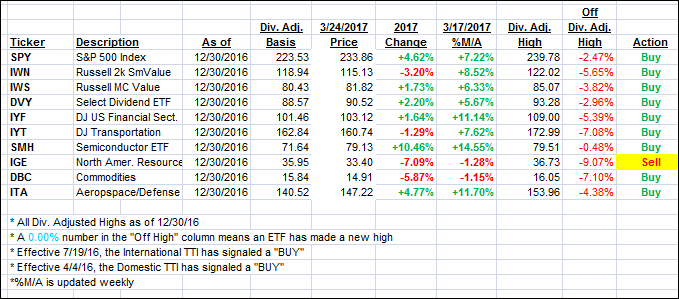

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the 2017 candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) closed down for the week as the major indexes lost upward momentum.

Here’s how we closed 3/24/2017:

Domestic TTI: +2.19% (last close +2.31%)—Buy signal effective 4/4/2016

International TTI: +5.31% (last close +5.63%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli