ETF Tracker StatSheet

Market Commentary

Trump Euphoria Fades

- Moving the Markets

On the surface, today’s payroll data was a resounding success with the US jobless rate falling to 9-year lows and employers adding some 178,000 jobs confirming that the 100% rate hike odds when the Fed meets later on this month may turn into reality.

Of course, as always, the devil about this “shining” jobs report is in the details as Americans no longer in the labor force soared to 95 million with a spike of 446,000 coming in November. The more troubling fact was that over the past three months did full-time jobs not only decline by 99,000, part-time jobs rose by an amazing 638,000 confirming that the quality of employment is not what it’s cracked up to be.

On the week, the markets suffered from a lack of enthusiasm as Trump euphoria waned and stocks bobbed and weaved, with ZH summing it up as follows:

- Nasdaq’s worst week since Feb 2016

- Small Caps worst week since Feb 2016

- Bank stocks up 4 weeks in a row to highest since Jan 2008

- FANG Stocks down 4 of the last 6 weeks

- Treasuries down 4 weeks in a row, TLT lowest close in a year

- USD Index down first time in 4 weeks

- Oil’s best week since Feb 2011 (at highest since July 2015)

- Gold down 4 weeks in a row to 10 month lows

This weekend, all eyes will be on Italy, which will cause some worry for the European markets as Sunday’s referendum has traders on edge. If the vote goes against the government, and there is a good chance of that, the PM will resign and will be replaced by an anti-euro party that could throw the Italian banks into crisis mode and the European markets into upheaval. Stay tuned!

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

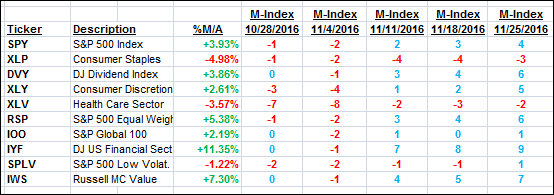

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

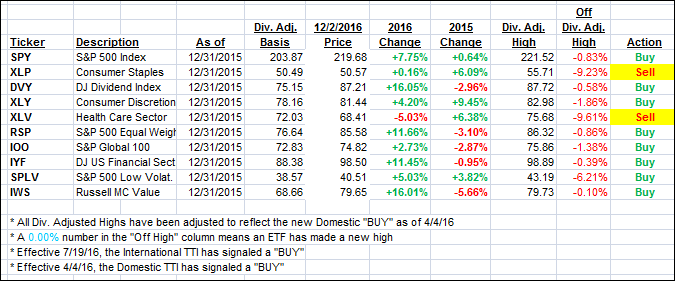

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) slipped with the major indexes heading south as enthusiasm about the Trump rally waned a bit.

Here’s how we closed 12/2/2016:

Domestic TTI: +0.34% (last Friday +1.12%)—Buy signal effective 4/4/2016

International TTI: +1.48% (last Friday +2.28%)—Buy signal effective 7/19/2016

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli