ETF Tracker StatSheet

————————————————————-

————————————————————

Market Commentary

TURBULENCE CREEPING INTO MARKETS

1. Moving the Markets

Wall Street got a big wake-up call Friday as fears on an interest rate hike were exacerbated by news from the Fed, which indicated that an interest rate hike is just around the corner. All three major indexes closed down by at least 2.12%. Not helping sentiment was last night’s news that Japan might be steepening its yield curve, the effects of which could have far reaching market implications.

The so-called “hawkish” commentary by Eric Rosengren (President of the Federal Reserve Bank of Boston) follows the ECB’s decision this week to keep rates at current levels, which was a disappointment to investors who thought additional stimulus was needed to get the Eurozone economy moving again.

Prior to today’s decline, it had been a quiet and complacent period for stocks, with volatility very low, a development that was starting to make some investors nervous. Heading into today’s session, the S&P 500 had gone more than 50 trading days without a drop of 1% or more, only the 48th time that has happened since 1950, according to Sam Stovall, U.S. equity strategist at S&P Global Market Intelligence. I have repeatedly commented that this will come to an end at some point, and I am very curious to see if this is the beginning of a new prolonged downturn or if Central Banks will shift their jawboning in reverse and “talk” the markets back up next week. Stay tuned!

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

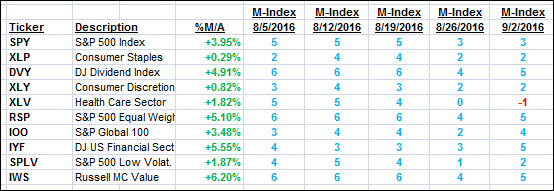

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

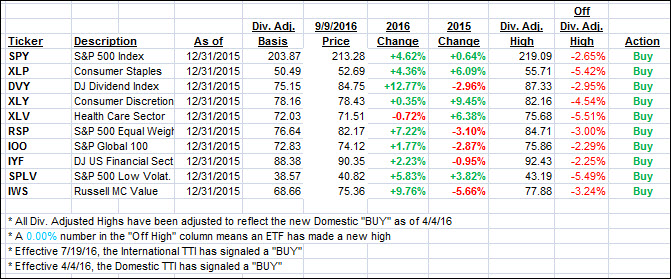

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) were yanked off their weekly highs by a large margin as today’s sell-off took no prisoners by pulling just about all asset classes lower.

Here’s how we closed 9/9/2016:

Domestic TTI: +1.75% (last Friday +2.92%)—Buy signal effective 4/4/2016

International TTI: +4.02% (last Friday +5.39%)—Buy signal effective 7/19/2016

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli