ETF Tracker StatSheet

————————————————————-

————————————————————

Market Commentary

ALGOS PLAY HEADLINE HOCKEY WITH JOBS NUMBERS

1. Moving the Markets

On the surface, the jobs report was awesome as payrolls rose by 255,000 month over month compared to an expected 180,000 gain. June was revised upwards from 287,000 to 292,000 with the total upward revision for May and June being 18,000.

Computer algos had a field day by pushing the indexes higher.

In the end, what it means is that after 2 months of missing expectations, the numbers have “miraculously” come in above forecasts due to seasonal adjustments. One strategist pointed out that today’s jobs report was “nowhere near as strong as the headline and that private payrolls were unadjusted +85k in July vs seasonally adjusted +217k.”

Stock market investing has now been made extremely simple. The S&P 500 climbed into record territory with the help of a better than expected jobs report which, if the numbers are actually correct, has just increased the interest rate hike odds. Simply said, higher interest rates are now good news too, while bad economic numbers are even greater news as it means the Fed will stay pat with the rate hike game. See how logical this all is?

Of course, I am being facetious; the reality is you can’t have it both ways for any length of time, something has to give, i.e. a strengthening economy will cause rates to be hiked at some point, which will cause equities to pull back.

To demonstrate the above that, no matter what, “all” news is good news, ZH featured this incredible chart, which tells it all:

I can’t help but just laugh out loud about that much manipulation.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

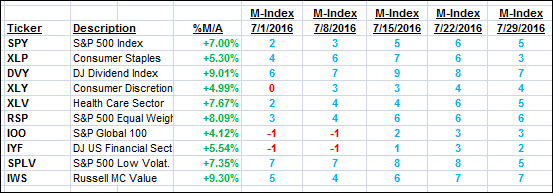

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

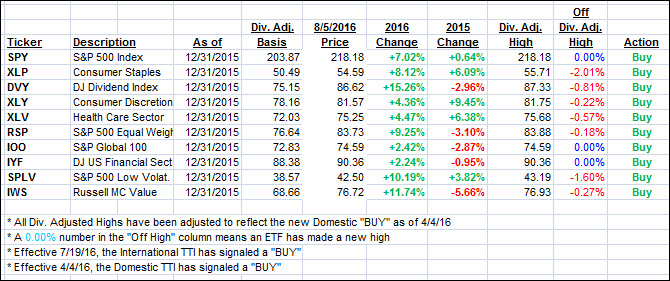

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) barely changed from last Friday despite today’s push into record territory.

Here’s how we closed 8/5/2016:

Domestic TTI: +3.13% (last Friday +3.13%)—Buy signal effective 4/4/2016

International TTI: +3.53% (last Friday +3.50%)—Buy signal effective 7/19/2016

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli