ETF Tracker StatSheet

————————————————————-

————————————————————

Market Commentary

MARKETS SLIPPING WHILE OIL IS GUSHING HIGHER

1. Moving the Markets

U.S. markets closed lower today to finish the week as traders appeared slightly anxious about the possibility of an earlier-than-expected Federal Reserve interest-rate hike. It seems that comments from senior Fed officials in recent days suggest a bias toward raising benchmark U.S. interest rates. This has subsequently pushed investors to re-examine minutes from the U.S. central bank’s most recent meeting in July and think more stringently about a potential rate hike before year end 2016.

In the world of tech, there were a few headlines today noting that Google’s stock celebrated its 12th anniversary of being on the public exchange. And, while the stock has gained about 1,780% since its IPO back in 2004 (at $42 a share), there are a few other tech stocks that have performed better during that same time frame that you might not be aware of.

These companies include Priceline (PCLN), Netflix (NFLX), Salesforce.com (CRM), Amazon.com (AMZN) and its Google’s arch rival Apple (AAPL). Analysts remain bullish on the future of the stock though, and anticipating that the stock could be worth $935 a share in 18 months. That would put it 17% higher than the Friday’s closing price of $799.65 per share.

U.S. Crude Oil has been ‘on fire’ this week rising towards once again towards the $50 per barrel mark. While the ‘black gold’ hasn’t passed the $50 per barrel mark recently, it remains a tipping point that could move markets back in the opposite direction.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

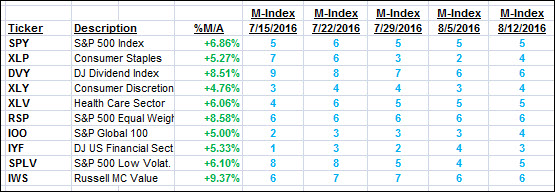

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

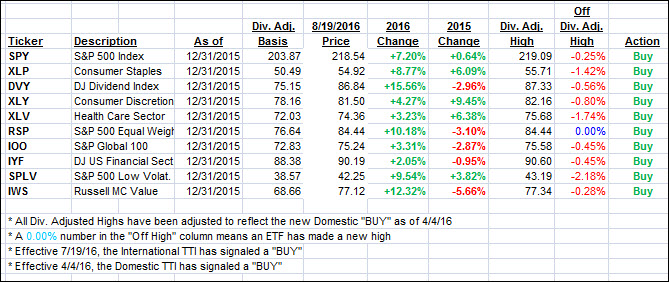

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) barely moved as the major indexes bounced around the unchanged line all week with no gains in the end for the S&P 500.

Here’s how we closed 8/19/2016:

Domestic TTI: +3.02% (last Friday +3.11%)—Buy signal effective 4/4/2016

International TTI: +4.72% (last Friday +4.68%)—Buy signal effective 7/19/2016

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli