ETF/No Load Fund Tracker StatSheet

————————————————————-

————————————————————

Market Commentary

S&P 500 NOTCHES 7TH RECORD HIGH FRIDAY DESPITE SOUR ‘POST-BREXIT’ DATA

1. Moving the Markets

Overall, it was a great week for the market here in the U.S. The S&P 500 hit a fresh record high today (its seventh this year) a day after the Dow fell from a nine-day run, wherein also notched a record high this week It seems investors are keeping their eyes on quarterly earnings reports and the release of the first post-Brexit economic data from Britain and Europe.

The surge higher for U.S. stocks has been driven in part by a decent start to the Q2 earnings season, as reports are coming in better than originally feared but are still negative. Heading into today’s trading session, 67% of the 103 companies that have reported in the S&P 500 have topped results, which is above the long-term average of 63%.

In addition to getting fresh earnings today from names like General Electric (GE) and Honeywell (HON), both which failed to impress what was forecasted, Wall Street is also digesting fresh manufacturing data from Europe and Britain, the first such data since the so-called ‘Brexit’ vote last month.

Again, as I have repeatedly posted, the Fed is no longer data dependent in its planned actions but is only concerned with propping up asset markets to keep the illusion of the recovery alive. Even a former governor has now admitted as much. While that theme can go on for a while, eventually it will end up badly as a correction to fair market value will have to occur; the uncertainty is just the timing of it. That’s why we always need to be aware and prepared to head for the exit doors once market behavior dictates such a move.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

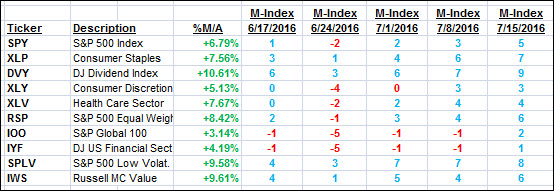

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

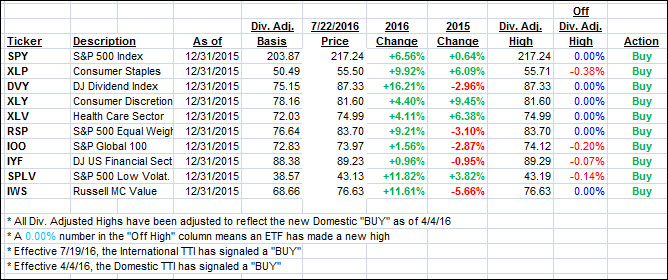

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) closed up as the major indexes pulled back mid-week but closed higher on Friday to end in the green.

Here’s how we closed 7/22/2016:

Domestic TTI: +2.85% (last Friday +2.60%)—Buy signal effective 4/4/2016

International TTI: +2.39% (last Friday +1.80%)—Buy signal effective 7/19/2016

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

Reader Ira:

Q: Hi Ulli- thanks for all you do to educate us. I have to admit- I was a bit spooked before Brexit, with other weaknesses, and exited my ETF positions. Now I find myself on the sidelines, however, I still don’t believe what I’m seeing, although there are articles saying the fundamentals have improved. What do you think- inch my way in over a few weeks, and then be more disciplined with the stops instead of cutting and running?

Thanks and best regards.

A: Ira: We are in a market environment that could be best described as insane or absolutely nutty, because nothing matters other than the “words of wisdom” central banker spew about in their attempt to prop the markets up and maintain the illusion that the recovery is alive and well.

As such, I can’t find fault with you exiting ahead of Brexit. To me, the most important aspect about investing is your comfort level, which is far more critical than what any investment methodology can provide you with. So, you’ve missed a little upside, but you also avoided a big potential downside disaster, which at some point is guaranteed to strike.

If you do decide you want to ease back in, simply use by incremental buying procedure, which is described in the video “How to know your investment risk tolerance.”

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli