1. Moving the Markets

Stocks extended their decline today as the Fed began its two-day policy meeting. The general sentiment is that rates are going to be hiked anytime soon, so that potential announcement is fairly well baked into prices throughout the market at this point; that’s the official version. Personally, when looking at the consistently deteriorating economic data points, it would seem to me that the Fed should be closer to cutting rather than hiking rates.

Be that as it may, Wall Street is curious as to what the Fed will say on Wednesday regarding the state of the economy and interest rates. However, the larger concern for investors around the globe is Britain’s referendum next week regarding whether or not they will stay in the European Union.

Many feel that if Britain does leave the EU that trade and investment would suffer, triggering a recession, hurting jobs, slamming the pound and causing house prices to fall, all of which is the scare mongering version of the government to keep the Brits aligned with establishment thinking. David Cameron is campaigning for Britain to stay in the bloc, but his Conservative party (and government) is bitterly divided over the issue.

And in wholesale news, Costco (COST) will begin accepting Visa cards on June 20th, officially ending the reign of American Express (AXP) dominance in the bulk retail giant. Citigroup (C) will be the issuer of Costco specific credit cards and it will be interesting to see how the stock responds. It currently stands at $155.87, which is $10 shy of its all-time high.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

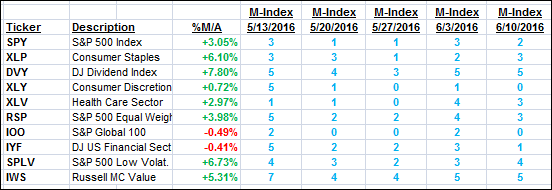

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

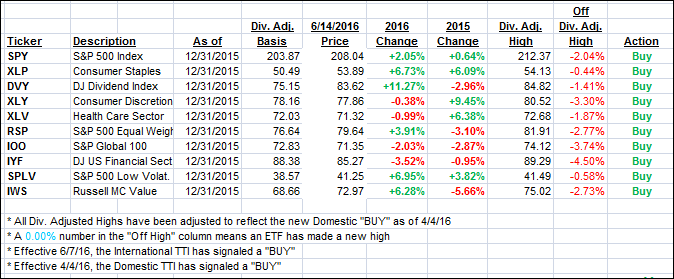

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) barely changed while the International one took another dive and resides now below its long-term trend line for the second day. Volatility has definitely picked up as the China, Japan and Europe indexes have been declining as of late. I will give it another couple of days to see if there is any improvement before pulling the trigger on what appears to be the latest International whip-saw signal. It could very well be that this is the proverbial canary in the coalmine with the Domestic TTI following suit shortly. Generally speaking, due to the Fed manipulating domestic markets, US stocks are usually the last to get the bearish message.

Here’s how we closed this 4th down-day:

Domestic TTI: +1.61% (last close +1.69%)—Buy signal effective 4/4/2016

International TTI: -1.87% (last close -0.93%)—Buy signal effective 6/7/2016

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli