ETF/No Load Fund Tracker StatSheet

————————————————————-

————————————————————

Market Commentary

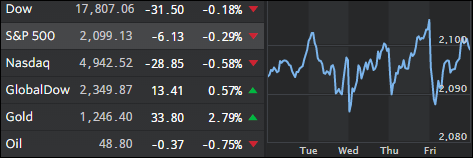

STOCKS IN RED AFTER DISAPPOINTING JOBS FIGURE

1. Moving the Markets

The “big” jobs report that analysts and investors alike were eyeing came in lower than expected, to say it politely; actually it was a total dud. 160,000 jobs were expected…and the survey says…38,000. The numbers are of course sub-par and will likely re-ignite worries among investors as to the trajectory of the U.S. economy heading into the summer.

At the same time, the numbers for the past two months were revised and actually 59,000 less than reported. Hmm, makes me wonder if the next month’s upcoming revision reduces jobs into negative territory for the month of May.

A slowing job market is not only bad news for U.S. workers, but could also force investors to re-think the Fed’s position on hiking interest rates in the coming months. Quotes from Yellen over the past have given prelude to a potential June rate hike and all eyes were on the jobs report today. Well, these numbers pretty much should have killed any ambition for June.

It will be interesting to see how the market responds next week once the reality of these numbers has sunk in. After the initial sell-off this morning, the major indexes were manipulated higher to control any downside damage. To my way of thinking, eventually there has to be a realization that while low interest rates are a positive by giving an assist to the markets, the fact that they are so low because of slowing or non-existent organic growth in the economy will be a negative in the long run.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

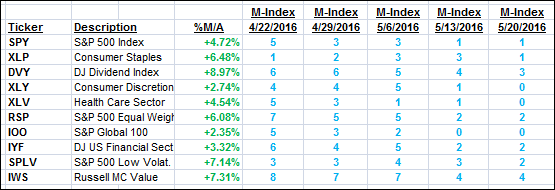

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

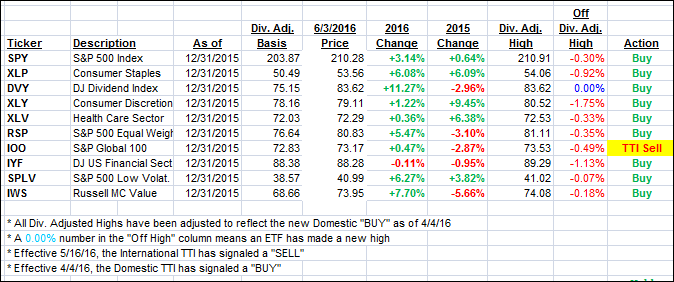

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) inched up this week solidifying its position in bullish territory. Its international cousin improved as well and should it remain around these current levels, a new BUY signal for that arena will be generated next week.

Here’s how we closed this week:

Domestic TTI: +2.09% (last Friday +1.88%)—Buy signal effective 4/4/2016

International TTI: +1.45% (last Friday +1.18%)—Sell signal effective 5/16/2016

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli